The ultimate goal of any normal business is to maximize profits - nobody does a day's work to lose money! As such, issues around profitability are understandably a recurring theme for working consultants and are the subject of many case interviews. We generally don’t advise using pre-planned frameworks, but knowing how to tailor a profitability framework to your specific case can help you in your interviews.

The subject of profitability is dealt with in detail in the MCC Academy course in a one hour video lesson which you can check out below:

Depending on your background knowledge, parts of this lesson might feel a little like being thrown in at the deep end - it is from around halfway through the MCC Academy course and builds on the content which has gone before it. Being able to crack profitability cases every time will require you to bring a fully developed skill set to interview. For instance, you will need a familiarity with basic finance theory and the ability to interpret accounting information. All of this is covered in depth by the MCC Academy.

In this article, rather than try to go through all the background, we will focus in on one of the main ways candidates go wrong when tackling profitability questions and how they can approach these cases more effectively.

Throughout the article, and again at the end, we point you towards resources to help get to grips with the relevant background material and develop the skills you will need to get through the analysis. Soon, you'll be ready for whatever profitability question your interviewer might throw at you!

Segmentation as a consulting tool to approach profitability differently

Candidates are often tempted to tackle profitability cases too hastily by employing a generic profitability framework - looking simply at high-level "aggregate" figures for incoming revenue and outgoing costs. This can seem sensible and will serve to generate some reasonable-sounding client recommendations.

However, in cases of any real complexity, taking this aggregate-level approach will mean you completely miss the underlying issue which is actually causing the client's problems.

At best, the "solutions" you generate will be superficial "sticking plasters", which might ameliorate a few symptoms of low profitability in the short term, but will not address the underlying problem causing the company to lose money. At worst, these "solutions" might inadvertently reduce profits and could bankrupt your client.

So, what do we need to do help a company get back to a healthy bottom line? The answer is that we need to start pulling apart headline "aggregate" figures to get into the nuts and bolts of how each different aspect of the company's activity contributes to revenues and costs.

This is to say that we need to "segment" different components of what our client does. Segmentation is one of the most powerful means by which practicing consultants deliver solutions to their clients, and is particularly useful in profitability cases.

If you would like some background on how to segment before getting into the specifics of profitability, we have a general article on segmentation, which you should check out. You should also look at our article on the MECE rule, which needs to be applied to make any successful segmentation.

Now, though, let's get a feel for the kind of problem that tends to come up, before working through an example case, which we solve via segmentation.

The typical problem in consulting

Consultants will often encounter some variation of the same scenario - a company has been relatively profitable over the last few years, but recent financial turmoil has created serious concerns. What to do? What a basic profitability framework tells you is to look at revenue and costs at an aggregate level.

From this start, you will likely arrive at recommending typical cost saving measures - such as improving procurement or marginally reducing the workforce. If you are lucky, these "sticking plaster" recommendations might achieve a small uptick in profits in the short term. However, this approach does not get to core of the problem.

The key is understanding how much each part of the business or product line contributes to profitability. It is here that segmentation can be so revealing. Segmentation lets us get to the heart of the root cause - and thus find the real solution to the fundamental problem.

An industry example

Let's work through an example of this kind of case. Say your interviewer gives you the following prompt:

A travel agency makes a 10% commission on all of its travel bookings. Their current profit before taxes is $3m, while the industry average ranges from $4-6m. Why are they making less than the industry average?

We will go step-by-step through a standard analysis using our Priority Driven Structure approach, showing both where many candidates might go wrong and how you can avoid making the same mistake.

1. Identify the problem

You respond with a few questions about the business model. Quickly, you gather that the Travel Agent’s job is pretty straightforward: they sell hotel rooms and get a fixed commission from the sale price.

Competitors do exactly the same. The industry appears fairly commoditized so, in principle, it is hard to understand why there should be large differences in profitability. Now you have enough information to begin to tackle the case.

Join thousands of other candidates cracking cases like pros

At MyConsultingCoach we teach you how to solve cases like a consultant Get started2. Modify your profitability framework guided by the Priority Driven Structure

This is a fairly straightforward profitability case. The main aims are:

- Understanding why we make less than our competitors

- Identifying the cost structure (fixed vs. variable). The figures in themselves are not that important - what really matters is how costs vary with changing volume

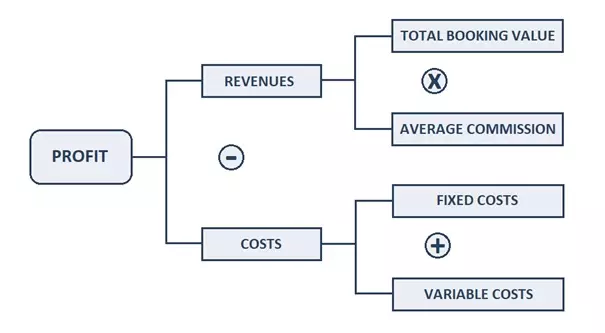

First, profit should be broken down into revenues and costs as usual. For our travel agent, profit is the product of:

- Total booking value

- Average Commission

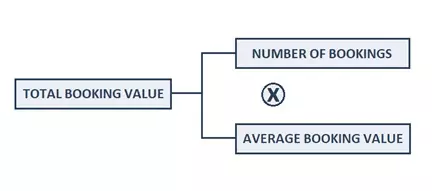

The total booking value can be further broken down into:

- Number of bookings

- Average booking value

As usual, costs are separated into fixed and variable components. At this stage, for this simple case, our structure is similar to a common profitability framework and the tree structure is like most other profitability trees.

3. Lead the cost analysis

With our basic tree structure complete, we can start to move towards a solution. We will deal with the revenue and costs parts of the structure sequentially.

3.1. Revenue side

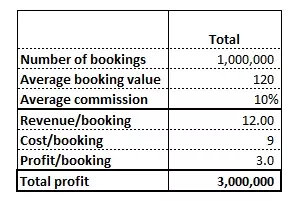

After asking a few more questions, you find out that our company's commission is at the same level as that of our competitors and that our total booking value is actually higher. Hence, our revenue is higher than that of our competitors.

Breaking down the total booking value (as shown below) into average booking value and number of bookings, we find out that we have more bookings than our competitors, but our average booking value is lower. The specific profitability tree would look like this:

3.2. Cost side

After some further questions, it turns out that the costs side is quite straightforward. Fixed costs are identical between us and our competitors, so we can safely ignore them for the purpose of this exercise and don’t have to include them in our profitability trees. Variable costs per booking are also constant across the industry at $9, though our total is obviously higher due to our higher number of bookings.

3.3. The typical mistake...

The usual response to this kind of typical profitability problem is to make the same, typical mistake. At first sight, the key takeaway from our structure seems to be that our problem is with average booking value - especially considering the fact that increasing commissions beyond the competition in a commoditized market is likely going to be counter-productive. It looks like the best solution to our problem is to be found in simply convincing our current customers to spend more. At this point you may come up with a list of potential initiatives incentivizing our customers to spend more and the case looks complete. Unfortunately, this is only a partial - and misleading - solution.

3.4. The power of segmentation

Rather than making this predictable mistake and ending up with an unsatisfactory answer, we should instead use segmentation to get at the root of the problem. This is a key component of Leading the Analysis, as explained in our Case Academy.

When the cause of lower profitability is unclear at an aggregate level, segmentation enables us to assess how profitable each customer is. We can reasonably expect different customers to bring different levels of profitability, but it could also be the case that some customers are actually draining profit.

Looking for an all-inclusive, peace of mind program?

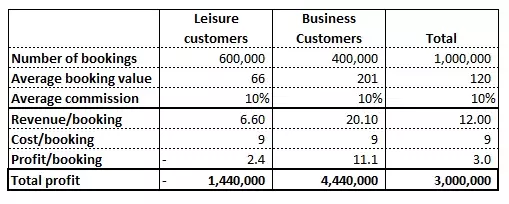

Choose our mentoring programs to get access to all our resources, a customised study plan and a dedicated experienced MBB mentor Learn moreUsing business intuition and a hypothesis-driven approach, we can immediately see that the average booking value is the most relevant bucket to investigate: costs are standard and our market share is likely to be difficult to increase drastically when that market is so competitive. As you communicate this to your interviewer and go on to segment further, you are given the information in the table below, which tells us that there are two types of customers: leisure and business travellers.

The average booking value of $120 is an average of:

- $66 spent by leisure travellers

- ~$200 spent by business travellers

Your first move here might be to calculate the total profit for each category. However, this is not necessary and would actually represent a sizable waste of time in an interview. Instead, it is quicker and more enlightening to simply calculate the profit per booking.

For every leisure traveller, then, we get an average of $6.60 in commission, but spend $9 in variable costs. This means that for each leisure traveller, we lose an average of $2.40!

4. Provide specific recommendations

If we only served business customers, our total profit would increase by almost 50% overnight. We can achieve this simply by turning down leisure customers, so our client can actually make more money by doing less!

Forget outdated, framework-based guides...

Interviewers are sick of seeing candidates miss the point and make the same old mistakes. Stand out from the crowd by learning to think like a working consultant! Get startedA different way to view profitability problems

So, we have seen how we can use segmentation to boost our travel agent's bottom line. A case that could apparently be solved using a standard profitability framework turned out to be slightly more complex. This is true for most, if not all, MBB cases.

As such, it's important to be familiar with all the fundamental consulting ideas to build solutions from first principles. In this case (and in most other cases) having a solid understanding of segmentation is fundamental. This knowledge will allow you to draw customized profitability trees and not rely on a generic profitability framework.

As we noted, the most intuitive way of looking at a basic profitability problem is simply by considering the overall difference between total revenue and total costs. After all, it is easy to calculate total profit:

profit = revenue - cost

However, thinking a little more deeply, it is much better to transition to considering overall profit as the sum of individual profit generated by each customer. Each specific customer will be generating some revenue and causing some costs. This transition from an aggregate to a more "particulate" mode of thought is key.

At the aggregate level:

profit = (average revenue per customer - average cost per customer) × number of customers

The fact that the average revenue per customer is higher than the average cost per customer means that the average profit per customer is positive - and so the company as a whole is profitable. However, this does not provide any specific information about different customers.

There might well be customers (or segments of customers) generating negative average profits, whilst other segments are making up for them by generating a positive average profit. If the company is profitable, all we know is that customers contributing positively are more than compensating for any who are contributing negatively.

As with our example here the key to profitability will thus often lie in finding out which customer segments are more or less beneficial, or even detrimental, to sell to.

It is important to note that segmentation is not limited to breaking down different groups of customers, as we have seen so far. Exactly the same method can be applied by dividing up the different kinds of products sold by a company. Once you understand the method, you should have no trouble drawing up specific profitability trees.

Thus, a fashion brand like Hermes might find that it makes a loss on high-end leather goods like handbags and luggage due to very high costs associated with those products' raw materials and manufacture. However, that same brand might still turn a profit overall by virtue of hefty positive contribution from relatively cheap-to-manufacture but high-price accessories like ties and scarves.

Such a brand might want to adjust its product mix if it wishes to increase profits (though, particularly for fashion houses, these products are often intentionally kept on as "loss leaders").

Whichever way segmentation is carried out, the goal is the same: segmentation helps you to discern customers or products which might be contributing less to profitability or even generating losses. Once you have this information, it should be relatively straightforward to come up with ways to increase profit (as with recommending our travel agent ceases to serve leisure customers).

These recommendations can then be given to the client in the knowledge that they target the underlying problem faced by the company rather than just representing an attempt to paper over the cracks.

A very real business problem

Our travel agent's case reveals what is in fact an extremely common problem for companies today: some products, business lines, or customers are actually generating losses.

This means companies incur extra costs just by persisting with these aspects of the business, and that their profitability can be boosted by a significant amount just by axing loss-making business lines. As we have explained, the key to solving this problem is evaluating the profit contribution of one additional product or customer in each segment.

Doing so will enable us to understand whether that segment is actually creating or draining value for the company. This is the kind of work consultants do every day and thus the kind of scenario that is likely to come up in a case interview.

Going further...

Following the Problem Driven Approach, together with a solid understanding of segmentation, should help to set you ahead of the competition when it comes to profitability cases. However, you should not forget that your analysis has to be grounded in a wider set of skills. Many of the other articles on this site will be relevant, especially those on costs, the MECE concept. You will also benefit from improving your mathematics skills, both to interpret data and to get through calculations quickly and accurately.

The MCC Academy has all the material you need to excel in profitability cases: besides a video dedicated to profitability, you will find videos on the fundamentals of finance and accounting, consulting thinking, including "differential reasoning" which was used to tackle this case and much more!

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.