1. The key to landing your consulting job.

A case interview is a core element of the consulting recruitment process at top firms like McKinsey, Bain, and BCG (the “MBB” firms). During a case interview, you will be asked to solve a business case study, which challenges you to think critically and strategically, just like a real consultant. Beyond MBB, firms like LEK, Kearney, Oliver Wyman, and the Big Four (PwC, Deloitte, EY, KPMG) also use case study interviews as a major component of their hiring process.

Why Case Interviews Are Essential

If your goal is to land a role at one of these prestigious consulting firms, you’ll need to master multiple case interviews. These interviews test your ability to think on your feet, structure complex problems, and provide actionable business solutions. Successfully cracking a consulting case interview is a critical step in consulting interview preparation.

The Rise of Online Case Interviews

In addition to traditional face-to-face case interviews, firms are increasingly adopting online case interview formats. Many candidates now face AI-driven case studies or cases delivered by chatbots. These assessments might occur before the actual interview or in tandem with first-round consulting interviews. Knowing how to approach these online assessments is key to staying competitive in today’s consulting interview process.

Why You Need to Prepare Thoroughly for Case Interviews

It’s important to note that case interviews are not something you can approach casually or "wing." Consulting firms explicitly expect candidates to be well-prepared, and many of your competitors will have been practicing for months. Lack of preparation is a major reason why candidates fail. That’s where MCC is here to guide you every step of the way!

What This Guide Will Cover

This guide provides a comprehensive overview of consulting case interviews. You’ll learn everything from how to approach case studies like a consultant to mastering the emerging online case formats. Along the way, we’ll direct you to more detailed articles and resources that let you dive deeper into key aspects of the consulting interview process.

If you prefer a video guide, you can watch the video below:

Key Topics Covered:

- What is the standard format of a case interview?

- What skills are firms like McKinsey, Bain, and BCG looking for?

- How are candidates assessed in case interviews?

- What strategies can you use to ace a consulting case study?

With these insights, you’ll have a clear understanding of what to expect and how to excel in your consulting case interviews. Let’s get started!

Professional help

Before we go any further, if this feels overwhelming, don’t worry — we’re here to help! Whether you need guidance to refine your preparation or prefer an experienced consultant to guide you through the entire selection process, we’ve got you covered. Explore our tailored coaching packages below.

2. What is a Case Interview?

A case interview simulates real consulting work by having you solve a business case study in conversation with your interviewer. You’ll be tasked with advising a client (an imaginary business or organization) on how to solve a problem or make a decision. Your job is to analyze the provided information and make a final recommendation.

While some business problems may seem straightforward, consulting firms focus on solving complex, unique issues that require creative, non-standard solutions.

Examples of case questions include:

- How much would you pay for a banking license in Ghana?

- Estimate the potential value of the electric vehicle market in Germany.

- How much gas storage capacity should a UK domestic energy supplier build?

Consulting firms seek bright minds to work on these challenging, real-world problems. You’ll need to think outside the box and be prepared for novel solutions during your interview.

2.1. Where Are Case Interviews in the Consulting Selection Process?

Not everyone who applies to a consulting firm will make it to a case interview. In fact, firms eliminate up to 80% of candidates before the interview stage. This is because case interviews are expensive and time-consuming, requiring firms to pull consultants from active projects.

Most candidates are cut based on their resumes and performance in aptitude tests. For example, McKinsey uses its Solve assessment and resumes to eliminate over 70% of applicants before interviews.

Getting to a case interview with a top firm is already an achievement. You’ll need to get through the resume screen, aptitude tests, and possibly other assessments to reach the interview stage.

Let’s take a closer look at the selection process, including application screens, aptitude tests, and interview rounds.

2.1.1. Application Screen

A large portion of candidates are eliminated at the application stage. Resumes and cover letters are often reviewed by a combination of AI tools, recruitment staff, and consulting staff.

To improve your chances, make sure your resume and cover letter are top-notch. Check out our free resume guide and cover letter guide, or consider getting help with editing.

2.1.2. Aptitude Tests and Online Cases

The selection process has been evolving quickly, with firms increasingly using sophisticated online case studies in addition to traditional aptitude tests.

McKinsey now uses an online case as part of its Solve assessment, while BCG’s Casey chatbot directly replaces a live first-round interview. We expect these online cases to become more prevalent in the future, but they are still just simulations of live case interviews.

Whether you’re dealing with an online case or a live interview, your preparation will remain the same. You’ll still need to learn how to solve cases effectively.

2.1.3. Rounds of Interviews

Despite the rise of AI and online cases, live case interviews are still central to consulting selection. Firms will always require live interviews due to the client-facing nature of consulting.

To secure an offer from McKinsey, Bain, BCG, or a similar firm, you’ll need to complete four to six case interviews, typically split across two rounds. Each interview will last approximately 50-60 minutes.

First-round interviews usually consist of two or three case interviews, sometimes accompanied by an online case. If you perform well in the first round, you’ll be invited to a second, more challenging round. After successfully completing up to six case interviews, you may receive an offer.

2.2. Differences between first and second round interviews

Despite case interviews in the first and second round following the same format, second/final round interviews will be significantly more intense. The seniority of the interviewer, time pressure (with up to three interviews back-to-back), and the sheer value of the job at stake will likely make a second round consulting case interview one of the most challenging moments of your professional life.

There are three key differences between the two rounds:

- Time Pressure: Final round case interviews test your ability to perform under pressure, with as many as three interviews in a row and often only very small breaks between them.

- Focus: Since second round interviewers tend to be more senior (usually partners with 12+ years experience) and will be more interested in your personality and ability to handle challenges independently. Some partners will drill down into your experiences and achievements to the extreme. They want to understand how you react to challenges and your ability to identify and learn from past mistakes.

- Psychological Pressure: While case interviews in the first round are usually more focused on you simply cracking the case, second round interviewers often employ a "bad cop" strategy to test the way you react to challenges and uncertainty.

2.3. What skills do case interviews assess?

Reliably impressing your interviewers means knowing what they are looking for. This means understanding the skills you are being assessed against in some detail.

Overall, it’s important always to remember that, with case studies, there are no strict right or wrong answers. What really matters is how you think problems through, how confident you are with your conclusions and how quick you are with the back of the envelope arithmetic.

The objective of this kind of interview isn’t to get to one particular solution, but to assess your skillset. This is even true of modern online cases, where sophisticated AI algorithms score how you work as well as the solutions you generate.

If you visit McKinsey , Bain and BCG web pages on case interviews, you will find that the three firms look for very similar traits, and the same will be true of other top consultancies.

Broadly speaking, your interviewer will be evaluating you across five key areas:

2.1.1.One: Probing mind

Showing intellectual curiosity by asking relevant and insightful questions that demonstrate critical thinking and a proactive nature. For instance, if we are told that revenues for a leading supermarket chain have been declining over the last ten years, a successful candidate would ask:

“We know revenues have declined. This could be due to price or volume. Do we know how they changed over the same period? ”

This is as opposed to a laundry list of questions like:

- Did customers change their preferences?

- Which segment has shown the decline in volume?

- Is there a price war in the industry?

2.1.2. Structure

Structure in this context means structuring a problem. This, in turn, means creating a framework - that is, a series of clear, sequential steps in order to get to a solution.

As with the case interview in general, the focus with case study structures isn’t on reaching a solution, but on how you get there.

This is the trickiest part of the case interview and the single most common reason candidates fail.

We discuss how to properly structure a case in more detail in section three. In terms of what your interviewer is looking for at high level, though, key pieces of your structure should be:

- Proper understanding of the objective of the case - Ask yourself: "What is the single crucial piece of advice that the client absolutely needs?"

- Identification of the drivers - Ask yourself: "What are the key forces that play a role in defining the outcome?"

Our Problem Driven Structure method, discussed in section three, bakes this approach in at a fundamental level. This is as opposed to the framework-based approach you will find in older case-solving

Focus on going through memorised sequences of steps too-often means failing to develop a full understanding of the case and the real key drivers.

2.1.3. Problem Solving

You’ll be tested on your ability to identify problems and drivers, isolate causes and effects, demonstrate creativity and prioritise issues. In particular, the interviewer will look for the following skills:

- Prioritisation - Can you distinguish relevant and irrelevant facts?

- Connecting the dots - Can you connect new facts and evidence to the big picture?

- Establishing conclusions - Can you establish correct conclusions without rushing to inferences not supported by evidence?

2.1.4. Numerical Agility

In case interviews, you are expected to be quick and confident with both precise and approximated numbers. This translates to:

- Performing simple calculations quickly - Essential to solve cases quickly and impress clients with quick estimates and preliminary conclusions.

- Analysing data - Extract data from graphs and charts, elaborate and draw insightful conclusions.

- Solving business problems - Translate a real world case to a mathematical problem and solve it.

Our article on consulting math is a great resource here, though the extensive math content in our MCC Academy is the best and most comprehensive material available.

2.1.5. Communication

Real consulting work isn’t just about the raw analysis to come up with a recommendation - this then needs to be sold to the client as the right course of action.

Similarly, in a case interview, you must be able to turn your answer into a compelling recommendation. This is just as essential to impressing your interviewer as your structure and analysis.

Consultants already comment on how difficult it is to find candidates with the right communication skills. Add to this the current direction of travel, where AI will be able to automate more and more of the routine analytic side of consulting, and communication becomes a bigger and bigger part of what consultants are being paid for.

So, how do you make sure that your recommendations are relevant, smart, and engaging? The answer is to master what is known as CEO-level communication.

This art of speaking like a CEO can be quite challenging, as it often involves presenting information in effectively the opposite way to how you might normally.

To get it right, there are three key areas to focus on in your communications:

- Top down: A CEO wants to hear the key message first. They will only ask for more details if they think that will actually be useful. Always consider what is absolutely critical for the CEO to know, and start with that. You can read more in our article on the Pyramid Principle.

- Concise: This is not the time for "boiling the ocean" or listing an endless number possible solutions. CEOs, and thus consultants, want a structured, quick and concise recommendation for their business problem, that they can implement immediately.

- Fact-based: Consultants share CEOs' hatred of opinions based on gut feel rather than facts. They want recommendations based on facts to make sure they are actually in control. Always go on to back up your conclusions with the relevant facts.

Being concise and to the point is key in many areas, networking being one for them. For more detail on all this, check out our full article on delivering recommendations.

3. Types of case interview

While most case interviews share a similar structure, firms will have some differences in the particular ways they like to do things in terms of both the case study and the fit component.

As we’ll see, these differences aren’t hugely impactful in terms of how you prepare. That said, it's always good to know as much as possible about what you will be going up against.

3.1. Different case objectives

A guiding thread throughout this article and our approach in general will be to treat each case as a self-contained problem and not try to pigeonhole it into a certain category. Having said that, there are of course similarities between cases and we can identify certain parameters and objectives.

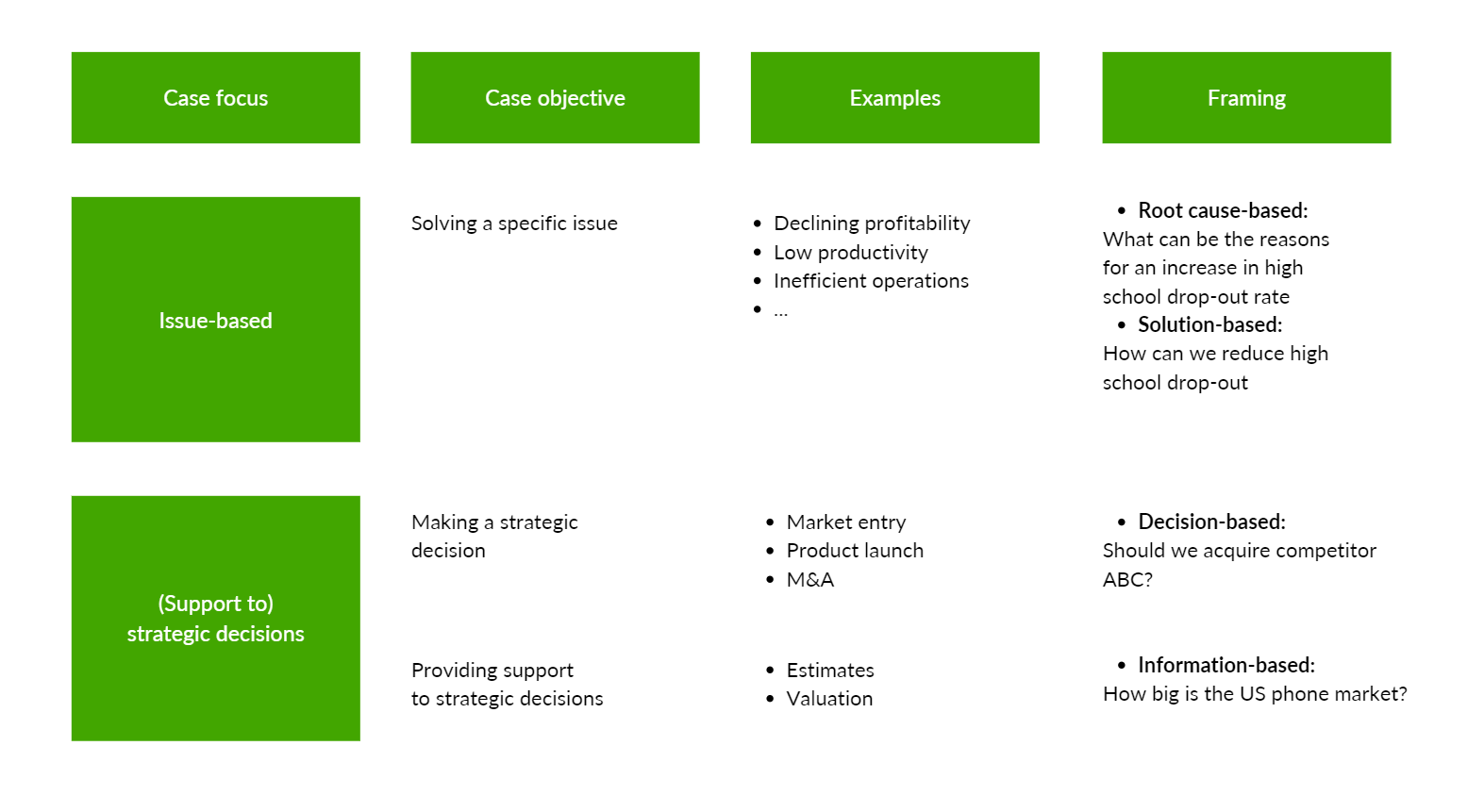

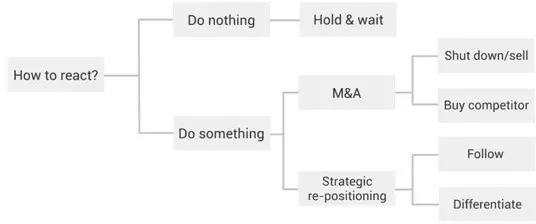

Broadly speaking, cases can be divided into issue-based cases and strategic decision cases. In the former you will be asked to solve a certain issue, such as declining profits, or low productivity whereas in the latter you will be ask whether your client should or should not do something, such as enter a specific market or acquire another company. The chart below is a good breakdown of these different objectives:

3.2. How do interviewers craft cases

While interviewers will very likely be given a case bank to choose from by their company, a good number of them will also choose to adapt the cases they would currently be working on to a case interview setting. The difference is that the latter cases will be harder to pigeonhole and apply standard frameworks to, so a tailored approach will be paramount.

If you’ve applied for a specific practice or type of consulting - such as operational consulting, for example - it’s very likely that you will receive a case geared towards that particular area alongside a ‘generalist’ consulting case (however, if that’s the case, you will generally be notified). The other main distinction when it comes to case interviews is between interviewer-led and candidate-led.

3.3. Candidate-led cases

Most consulting case interview questions test your ability to crack a broad problem, with a case prompt often going something like:

"How much would you pay to secure the rights to run a restaurant in the British Museum?"

You, as a candidate, are then expected to identify your path to solve the case (that is, provide a structure), leveraging your interviewer to collect the data and test your assumptions.

This is known as a “candidate-led” case interview and is used by Bain, BCG and other firms. From a structuring perspective, it’s easier to lose direction in a candidate-led case as there are no sign-posts along the way. As such, you need to come up with an approach that is both broad enough to cover all of the potential drivers in a case but also tailored enough to the problem you are asked to solve. It’s also up to you to figure out when you need to delve deeper into a certain branch of the case, brainstorm or ask for data. The following case from Bain is an excellent example on how to navigate a candidate-led case.

3.4. Interviewer-led cases

This type of case - employed most famously by McKinsey - is slightly different, with the interviewer controlling the pace and direction of the conversation much more than with other case interviews.

At McKinsey, your interviewer will ask you a set of pre-determined questions, regardless of your initial structure. For each question, you will have to understand the problem, come up with a mini structure, ask for additional data (if necessary) and come to the conclusion that answers the question. This more structured format of case also shows up in online cases by other firms - notably including BCG’s Casey chatbot (with the amusing result that practising McKinsey-style cases can be a great addition when prepping for BCG).

Essentially, these interviewer-led case studies are large cases made up of lots of mini-cases. You still use basically the same method as you would for standard (or candidate-led) cases - the main difference is simply that, instead of using that method to solve one big case, you are solving several mini-cases sequentially. These cases are easier to follow as the interviewer will guide you in the right direction. However, this doesn’t mean you should pay less attention to structure and deliver a generic framework! Also, usually (but not always!) the first question will ask you to map your approach and is the equivalent of the structuring question in candidate-led cases. Sometimes, if you’re missing key elements, the interviewer might prompt you in the right direction - so make sure to take those prompts seriously as they are there to help you get back on track (ask for 30 seconds to think on the prompt and structure your approach). Other times - and this is a less fortunate scenario - the interviewer might say nothing and simply move on to the next question. This is why you should put just as much thought (if not more) into the framework you build for interviewer-led cases, as you may be penalized if you produce something too generic or that doesn’t encompass all the issues of the case.

3.5. Case and fit

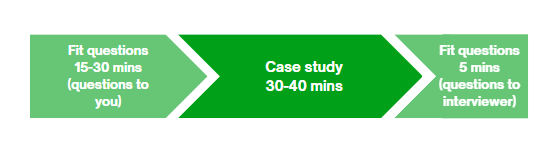

The standard case interview can be thought of as splitting into two standalone sub-interviews. Thus “case interviews” can be divided into the case study itself and a “fit interview” section, where culture fit questions are asked.

This can lead to a bit of confusion, as the actual case interview component might take up as little as half of your scheduled “case interview”. You need to make sure you are ready for both aspects.

To illustrate, here is the typical case interview timeline:

- First 15-30 minutes: Fit Interview - with questions assessing your motivation to be a consultant in that specific firm and your traits around leadership and teamwork. Learn more about the fit interview in our in-depth article here.

- Next 30-40 minutes: Case Interview - solving a case study

- Last 5 minutes: Fit Interview again - this time focussing on your questions for your interviewer.

Both the Case and Fit interviews play crucial roles in the finial hiring decision. There is no “average” taken between case and fit interviews: if your performance is not up to scratch in either of the two, you will not be able to move on to the next interview round or get an offer.

NB: No case without fit

Note that, even if you have only been told you are having a case interview or otherwise are just doing a case study, always be prepared to answer fit questions. At most firms, it is standard practice to include some fit questions in all case interviews, even if there are also separate explicit fit interviews, and interviewers will almost invariably include some of these questions around your case. This is perfectly natural - imagine how odd and artificial it would be to show up to an interview, simply do a case and leave again, without talking about anything else with the interviewer before or after.

3.5.2. The McKinsey PEI

McKinsey brands its fit aspect of interviews as the Personal Experience Interview or PEI. Despite the different name, this is really much the same interview you will be going up against in Bain, BCG and any similar firms.

McKinsey does have a reputation for pushing candidates a little harder with fit or PEI questions, focusing on one story per interview and drilling down further into the specific details each time. We discuss this tendency more in our fit interview article . However, no top end firm is going to go easy on you and you should absolutely be ready for the same level of grilling at Bain, BCG and others. Thus any difference isn’t hugely salient in terms of prep.

3.6. What is different in 2024?

For the foreseeable future, you are going to have to go through multiple live case interviews to secure any decent consulting job. These might increasingly happen via Zoom rather than in person, but they should remain largely the same otherwise.

However, things are changing and the rise of AI in recent months seems pretty much guaranteed to accelerate existing trends.

Even before the explosive development of AI chatbots like ChatGPT we have seen in recent months, automation was already starting to change the recruitment process.

As we mentioned, case interviews are expensive and inconvenient for firms to run. Ideally, then, firms will try to reduce the number of interviews required for recruitment as far as possible. For many years, tests of various kinds served to cut down the applicant pool and thus the number of interviews. However, these tests had a limited capacity to assess candidates against the full consulting skillset in the way that case interviews do so well.

More recently, though, the development of online testing has allowed for more and more advanced assessments. Top consulting firms have been leveraging screening tests that better and better capture the same skillset as case interviews. Eventually this is converging on automated case studies. We see this very clearly with the addition of the Redrock case to McKinsey’s Solve assessment.

As these digital cases become closer to the real thing, the line between test and case interview blurs. Online cases don’t just reduce the number of candidates to case interview, but start directly replacing them.

Case in point here is BCG’s Casey chatbot. Previously, BCG had deployed less advanced online cases and similar tests to weed out some candidates before live case interviews began. Now, though, Casey actually replaces one first round case interview.

Casey, at time of writing, is still a relatively “basic” chatbot, basically running through a pre-set script. The Whatsapp-like interface does a lot of work to make it feel like one is chatting to a “real person” - the chatbot itself, though, cannot provide feedback or nudges to candidates as would a human interviewer.

We fully expect that, as soon as BCG and other firms can train a truer AI, these online cases will become more widespread and start replacing more live interviews.

We discuss the likely impacts of advanced AI on consulting recruitment and the industry more broadly in our blog.

Here, though, the real message is that you should expect to run into digital cases as well as traditional case interviews.

Luckily, despite any changes in specific case interview format, you will still need to master the same fundamental skills and prepare in much the same way.

We’ll cover a few ways to help prepare for chatbot cases in section four. Ultimately, though, firms are looking for the same problem solving ability and mindset as a real interviewer. Especially as chatbots get better at mimicking a real interviewer, candidates who are well prepared for case cracking in general should have no problem with AI-administered cases.

3.6.1. Automated fit interviews

Analogous to online cases, in recent years there has been a trend towards automated, “one way” fit interviews, with these typically being administered for consultancies by specialist contractors like HireVue or SparkHire.

These are kind of like Zoom interviews, but if the interviewer didn’t show up. Instead you will be given fit questions to answer and must record your answer in your computer webcam. Your response will then go on to be assessed by an algorithm, scoring both what you say and how you say it.

Again, with advances in AI, it is easy to imagine these automated case interviews going from fully scripted interactions, where all candidates are asked the same list of questions, to a more interactive experience. Thus, we might soon arrive at a point where you are being grilled on the details of your stories - McKinsey PEI style - but by a bot rather than a human.

We include some tips on this kind of “one way” fit interview in section six here.

4. How to solve cases with the Problem-Driven Structure?

If you look around online for material on how to solve case studies, a lot of what you find will set out framework-based approaches. However, as we have mentioned, these frameworks tend to break down with more complex, unique cases - with these being exactly the kind of tough case studies you can expect to be given in your case interviews.

To address this problem, the MyConsultingCoach team has synthesized a new approach to case cracking that replicates how top management consultants approach actual engagements.

MyConsultingCoach’s Problem Driven Structure approach is a universal problem solving method that can be applied to any business problem, irrespective of its nature.

As opposed to just selecting a generic framework for each case interview, the Problem Driven Structure approach works by generating a bespoke structure for each individual question and is a simplified version of the roadmap McKinsey consultants use when working on engagements.

The canonical seven steps from McKinsey on real projects are simplified to four for case interview questions, as the analysis required for a six-month engagement is somewhat less than that needed for a 45-minute case study. However, the underlying flow is the same (see the method in action in the video below)

Let's zoom in to see how our method actually works in more detail:

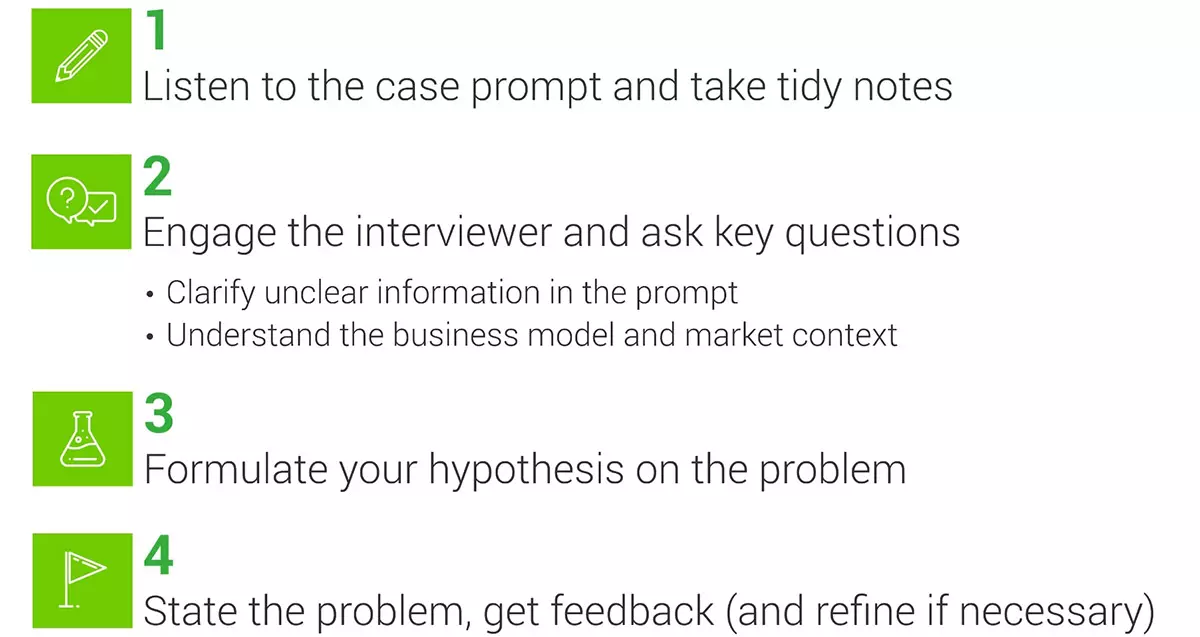

4.1. Identify the problem

Identifying the problem means properly understanding the prompt/question you are given, so you get to the actual point of the case.

This might sound simple, but cases are often very tricky, and many candidates irretrievably mess things up within the first few minutes of starting. Often, they won’t notice this has happened until they are getting to the end of their analysis. Then, they suddenly realise that they have misunderstood the case prompt - and have effectively been answering the wrong question all along!

With no time to go back and start again, there is nothing to do. Even if there were time, making such a silly mistake early on will make a terrible impression on their interviewer, who might well have written them off already. The interview is scuppered and all the candidate’s preparation has been for nothing.

This error is so galling as it is so readily avoidable.

Our method prevents this problem by placing huge emphasis on a full understanding of the case prompt. This lays the foundations for success as, once we have identified the fundamental, underlying problem our client is facing, we focus our whole analysis around finding solutions to this specific issue.

Now, some case interview prompts are easy to digest. For example, “Our client, a supermarket, has seen a decline in profits. How can we bring them up?”. However, many of the prompts given in interviews for top firms are much more difficult and might refer to unfamiliar business areas or industries. For example, “How much would you pay for a banking license in Ghana?” or “What would be your key areas of concern be when setting up an NGO?”

Don’t worry if you have no idea how you might go about tackling some of these prompts!

In our article on identifying the problem and in our full lesson on the subject in our MCC Academy course, we teach a systematic, four step approach to identifying the problem, as well as running through common errors to ensure you start off on the right foot every time!

This is summarised here:

Following this method lets you excel where your competitors mess up and get off to a great start in impressing your interviewer!

4.2. Build your problem driven structure

After you have properly understood the problem, the next step is to successfully crack a case is to draw up a bespoke structure that captures all the unique features of the case.

This is what will guide your analysis through the rest of the case study and is precisely the same method used by real consultants working on real engagements.

Of course, it might be easier here to simply roll out one an old-fashioned framework, and a lot of candidates will do so. This is likely to be faster at this stage and requires a lot less thought than our problem-driven structure approach.

However, whilst our problem driven structure approach requires more work from you, our method has the advantage of actually working in the kind of complex case studies where generic frameworks fail - that is exactly the kind of cases you can expect at an MBB interview.

Since we effectively start from first principles every time, we can tackle any case with the same overarching method. Simple or complex, every case is the same to you and you don’t have to gamble a job on whether a framework will actually work

In practice, structuring a problem with our method means drawing up either an issue tree or an hypothesis tree, depending on how you are trying to address the problem.

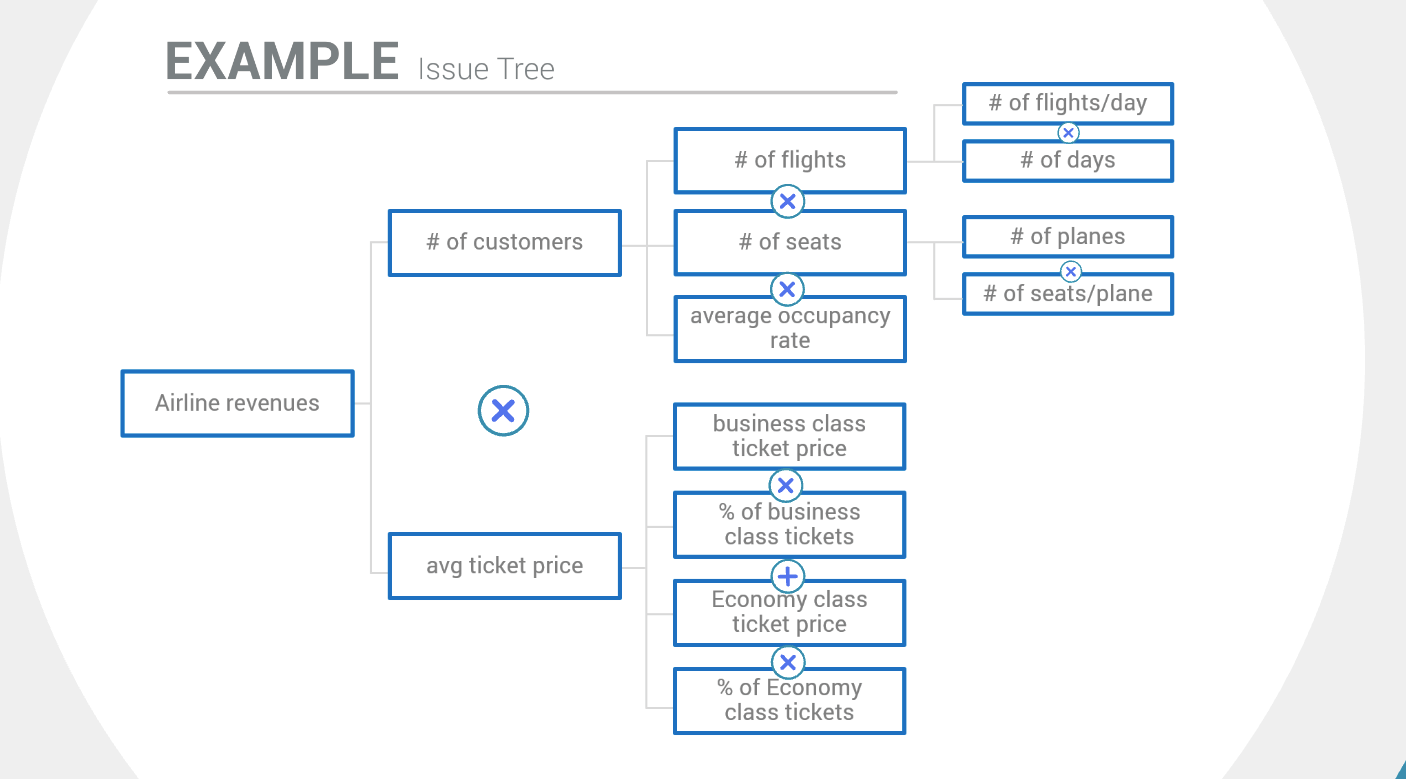

4.2.1 Issue trees

Issue trees break down the overall problem into a set of smaller problems that you can then solve individually. Representing this on a diagram also makes it easy for both you and your interviewer to keep track of your analysis.

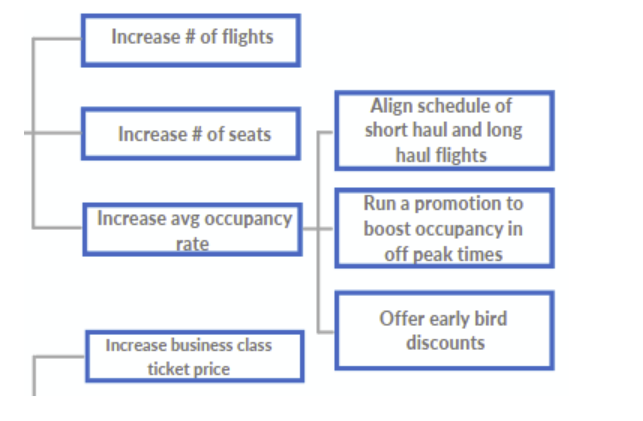

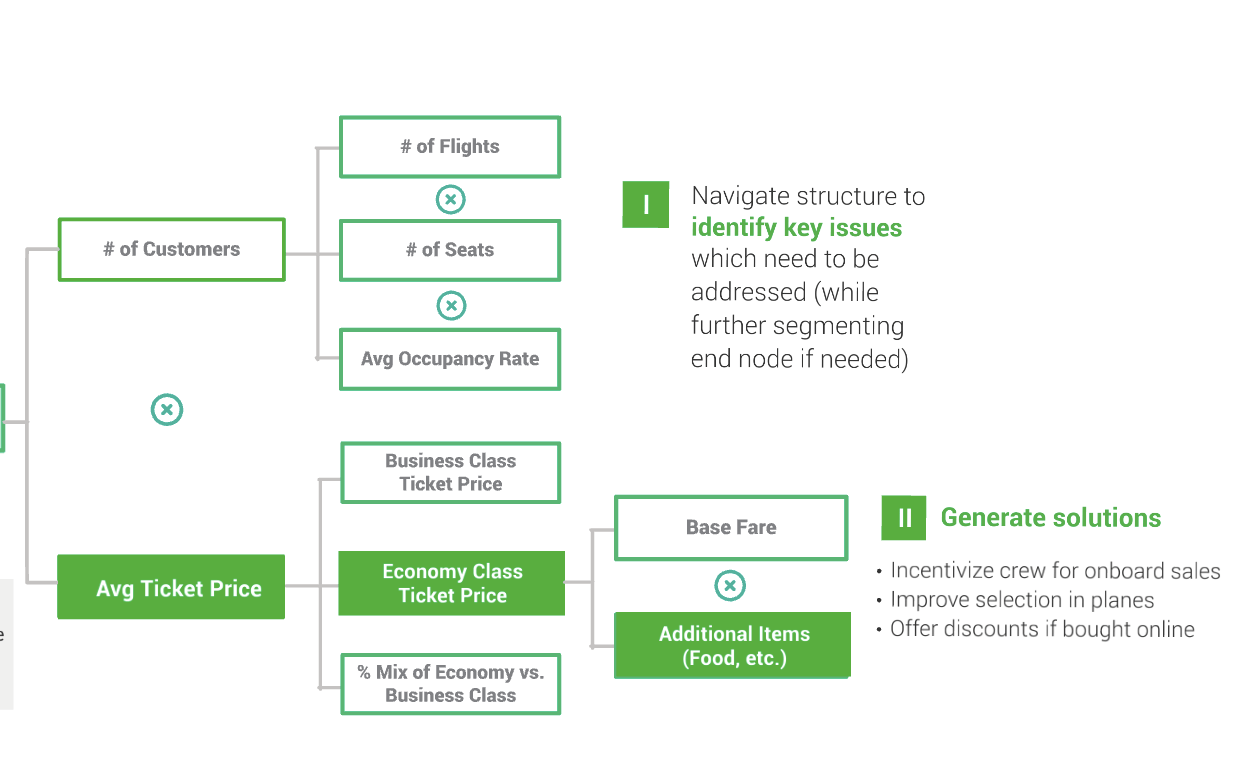

To see how this is done, let’s look at the issue tree below breaking down the revenues of an airline:

These revenues can be segmented as the number of customers multiplied by the average ticket price. The number of customers can be further broken down into a number of flights multiplied by the number of seats, times average occupancy rate. The node corresponding to the average ticket price can then be segmented further.

4.2.2 Hypothesis trees

Hypothesis trees are similar, the only difference being that rather than just trying to break up the issue into smaller issues you are assuming that the problem can be solved and you are formulating solutions.

In the example above, you would assume revenues can be increased by either increasing the average ticket price or the number of customers. You can then hypothesize that you can increase the average occupancy rate in three ways: align the schedule of short and long haul flights, run a promotion to boost occupancy in off-peak times, or offer early bird discounts.

4.2.3 Other structures:structured lists

Structured lists are simply subcategories of a problem into which you can fit similar elements. This McKinsey case answer starts off by identifying several buckets such as retailer response, competitor response, current capabilities and brand image and then proceeds to consider what could fit into these categories.

Buckets can be a good way to start the structure of a complex case but when using them it can be very difficult to be MECE and consistent, so you should always aim to then re-organize them into either an issue or a hypothesis tree.

It is worth noting that the same problem can be structured in multiple valid ways by choosing different means to segment the key issues. Ultimately all these lists are methods to set out a logical hierachy among elements.

4.2.4 Structures in practice

That said, not all valid structures are equally useful in solving the underlying problem. A good structure fulfils several requirements - including MECE-ness, level consistency, materiality, simplicity, and actionability. It’s important to put in the time to master segmentation, so you can choose a scheme isn’t only valid, but actually useful in addressing the problem.

After taking the effort to identify the problem properly, an advantage of our method is that it will help ensure you stay focused on that same fundamental problem throughout. This might not sound like much, but many candidates end up getting lost in their own analysis, veering off on huge tangents and returning with an answer to a question they weren’t asked.

Another frequent issue - particularly with certain frameworks - is that candidates finish their analysis and, even if they have successfully stuck to the initial question, they have not actually reached a definite solution. Instead, they might simply have generated a laundry list of pros and cons, with no clear single recommendation for action.

Clients employ consultants for actionable answers, and this is what is expected in the case interview. The problem driven structure excels in ensuring that everything you do is clearly related back to the key question in a way that will generate a definitive answer. Thus, the problem driven structure builds in the hypothesis driven approach so characteristic of real consulting practice.

You can learn how to set out your own problem driven structures in our article here and in our full lesson in the MCC Academy course.

4.2. Lead the analysis

A problem driven structure might ensure we reach a proper solution eventually, but how do we actually get there?

We call this step "leading the analysis", and it is the process whereby you systematically navigate through your structure, identifying the key factors driving the issue you are addressing.

Generally, this will mean continuing to grow your tree diagram, further segmenting what you identify as the most salient end nodes and thus drilling down into the most crucial factors causing the client’s central problem.

Once you have gotten right down into the detail of what is actually causing the company’s issues, solutions can then be generated quite straightforwardly.

To see this process in action, we can return to our airline revenue example:

Let’s say we discover the average ticket price to be a key issue in the airline’s problems. Looking closer at the drivers of average ticket price, we find that the problem lies with economy class ticket prices. We can then further segment that price into the base fare and additional items such as food.

Having broken down the issue to such a fine-grained level and considering the 80/20 rule(see below), solutions occur quite naturally. In this case, we can suggest incentivising the crew to increase onboard sales, improving assortment in the plane, or offering discounts for online purchases.

Our article on leading the analysis is a great primer on the subject, with our video lesson in the MCC Academy providing the most comprehensive guide available.

4.4. Provide recommendations

So you have a solution - but you aren’t finished yet!

Now, you need to deliver your solution as a final recommendation.

This should be done as if you are briefing a busy CEO and thus should be a one minute, top-down, concise, structured, clear, and fact-based account of your findings.

The brevity of the final recommendation belies its importance. In real life consulting, the recommendation is what the client has potentially paid millions for - from their point of view, it is the only thing that matters.

In a case interview, your performance in this final summing up of your case is going to significantly colour your interviewer’s parting impression of you - and thus your chances of getting hired!

So, how do we do it right?

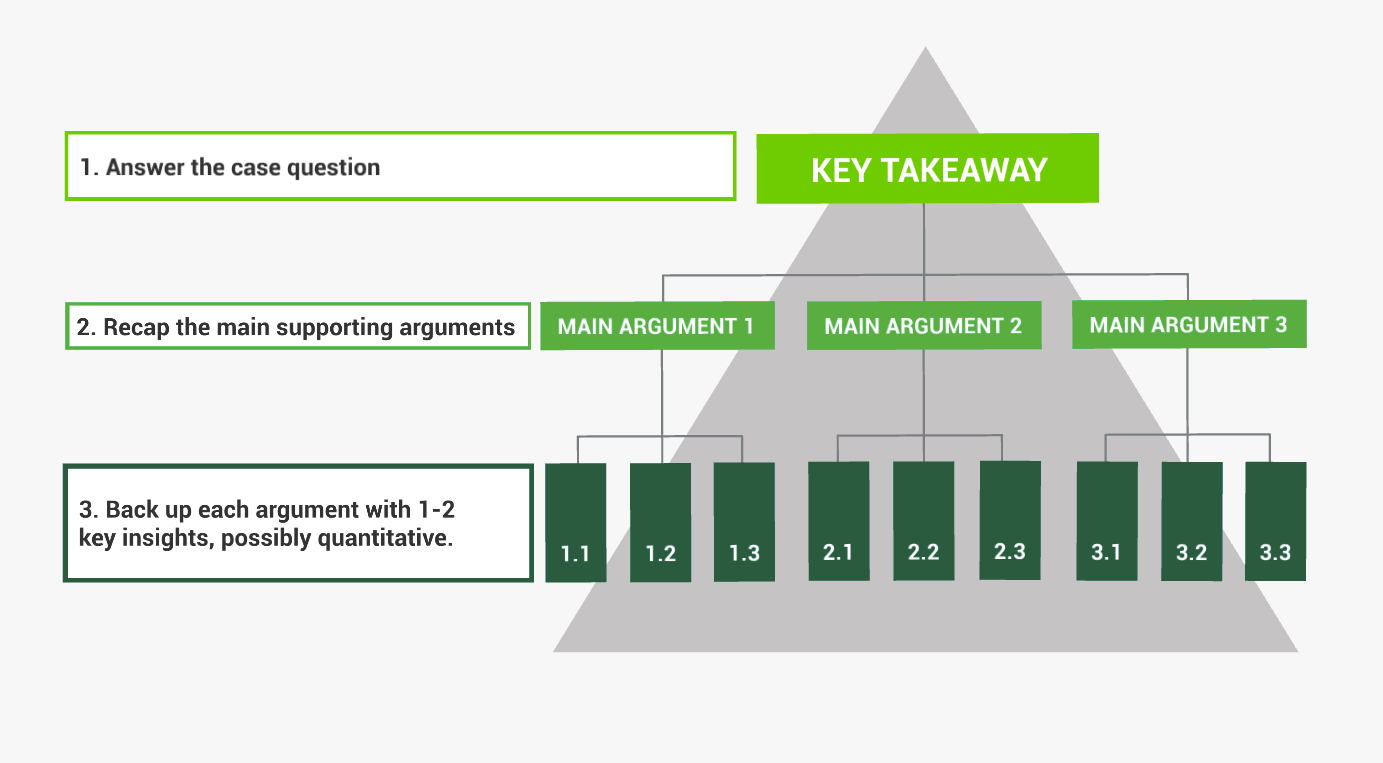

Barbara Minto's Pyramid Principle elegantly sums up almost everything required for a perfect recommendation. The answer comes first, as this is what is most important. This is then supported by a few key arguments, which are in turn buttressed by supporting facts.

Across the whole recommendation, the goal isn’t to just summarise what you have done. Instead, you are aiming to synthesize your findings to extract the key "so what?" insight that is useful to the client going forward.

All this might seem like common sense, but it is actually the opposite of how we relay results in academia and other fields. There, we typically move from data, through arguments and eventually to conclusions. As such, making good recommendations is a skill that takes practice to master.

We can see the Pyramid Principle illustrated in the diagram below:

To supplement the basic Pyramid Principle scheme, we suggest candidates add a few brief remarks on potential risks and suggested next steps. This helps demonstrate the ability for critical self-reflection and lets your interviewer see you going the extra mile.

The combination of logical rigour and communication skills that is so definitive of consulting is particularly on display in the final recommendation.

Despite it only lasting 60 seconds, you will need to leverage a full set of key consulting skills to deliver a really excellent recommendation and leave your interviewer with a good final impression of your case solving abilities.

Our specific article on final recommendations and the specific video lesson on the same topic within our MCC Academy are great, comprehensive resources. Beyond those, our lesson on consulting thinking and our articles on MECE and the Pyramid Principle are also very useful.

4.5. What if I get stuck?

Naturally with case interviews being difficult problems there may be times where you’re unsure what to do or which direction to take. The most common scenario is that you will get stuck midway through the case and there are essentially two things that you should do:

- 1. Go back to your structure

- 2. Ask the interviewer for clarification

Your structure should always be your best friend - after all, this is why you put so much thought and effort into it: if it’s MECE it will point you in the right direction. This may seem abstract but let’s take the very simple example of a profitability case interview: if you’ve started your analysis by segmenting profit into revenue minus costs and you’ve seen that the cost side of the analysis is leading you nowhere, you can be certain that the declining profit is due to a decline in revenue.

Similarly, when you’re stuck on the quantitative section of the case interview, make sure that your framework for calculations is set up correctly (you can confirm this with the interviewer) and see what it is you’re trying to solve for: for example if you’re trying to find what price the client should sell their new t-shirt in order to break even on their investment, you should realize that what you’re trying to find is the break even point, so you can start by calculating either the costs or the revenues. You have all the data for the costs side and you know they’re trying to sell 10.000 pairs so you can simply set up the equation with x being the price.

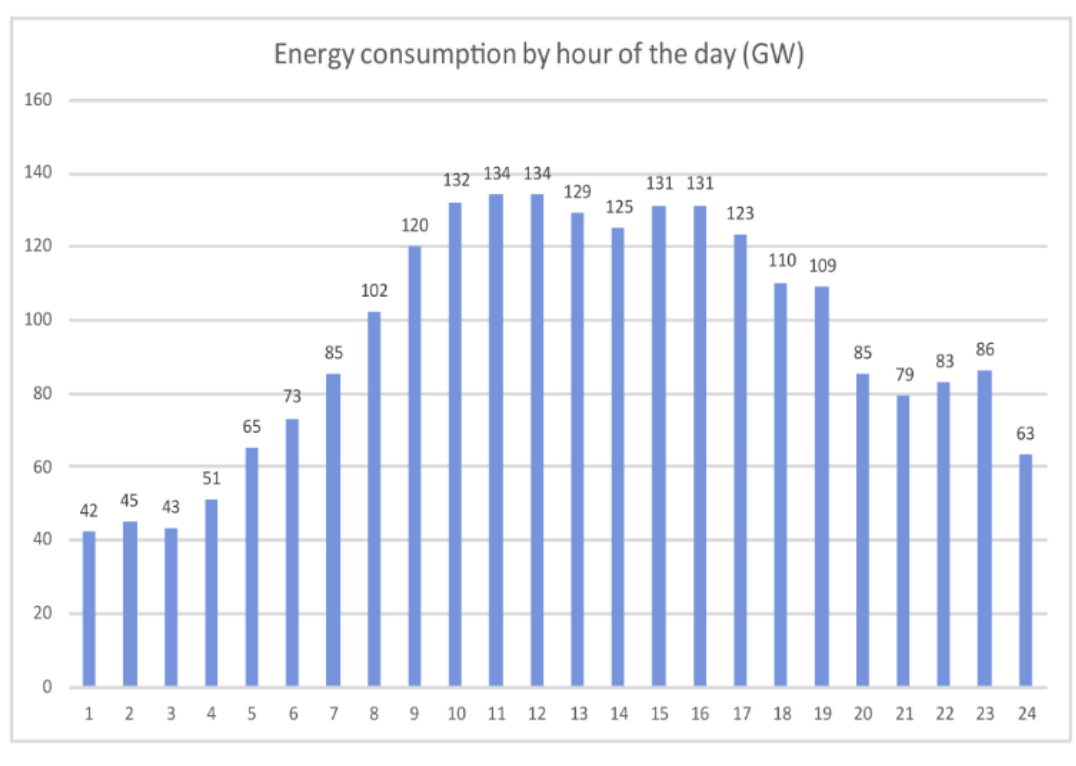

As we’ve emphasised on several occasions, your case interview will be a dialogue. As such, if you don’t know what to do next or don’t understand something, make sure to ask the interviewer (and as a general rule always follow their prompts as they are trying to help, not trick you). This is especially true for the quantitative questions, where you should really understand what data you’re looking at before you jump into any calculations. Ideally you should ask your questions before you take time to formulate your approach but don’t be afraid to ask for further clarification if you really can’t make sense of what’s going on. It’s always good to walk your interviewer through your approach before you start doing the calculations and it’s no mistake to make sure that you both have the same understanding of the data. For example when confronted with the chart below, you might ask what GW (in this case gigawatt) means from the get-go and ask to confirm the different metrics (i.e. whether 1 GW = 1000 megawatts). You will never be penalised for asking a question like that.

5. Inside the Consultant’s Mind: Tools to Crack Consulting Cases

If you’re new to case cracking, it’s easy to feel overwhelmed when faced with a complex case question, unsure of where to begin.

Fortunately, like chess, the basic rules of solving cases are straightforward. Our problem-driven structure provides a clear, high-level framework to guide you. However, just like becoming a chess master, true proficiency in case interviews comes from understanding the nuances and building your skills through time and practice.

Beyond the approach, there are additional strategies and insights that consultants use, which can give you an edge. In this section, we’ll provide an overview of the core concepts you need to know, while linking to in-depth resources that will help you dive deeper into each topic.

5.1. An overall clear structure

Consultants thrive on structure, and this is one of the most important aspects to keep in mind during case interviews. Not only is it a key evaluation criterion, but it’s also the greatest tool at your disposal for tackling complex cases. Let’s break down the areas where a clear structure will make all the difference.

5.1.1 Structured notes

Every case interview begins with a prompt, and your ability to take clear, concise, and structured notes is crucial. These notes should help you repeat the case back to the interviewer, without including unnecessary information.

A good approach is to divide your notes into sections for:

- The case brief

- Follow-up questions and answers

- Numerical data

- Case structure (crucial for solving the case)

- Scrap work (usually for calculations)

As you work through the case, keep feeding and integrating your structure to maintain a high-level view of the case and avoid losing focus. This is especially important in interviewer-led cases, where you might want separate sheets for each question.

5.1.2 Structured communication

There are three main types of communication in case interviews:

- 1. Asking and answering questions

- 2. Walking the interviewer through your structure

- 3. Delivering your recommendation

When asking questions, always take a moment to organize your thoughts. Numbering your questions and answers helps ensure clarity. The same goes for walking the interviewer through your structure—use a numbering system to outline your approach clearly.

Finally, when delivering your recommendation, use a top-down approach. Circle or mark key facts throughout the case so they’re easily accessible when needed.

5.1.3 Structured framework

Having a systematic approach or framework for every case is essential. There’s a key difference between applying a problem-solving framework and forcing a case into a predetermined one. The former is necessary, while the latter can be harmful.

Whether using buckets or issue trees, ensure your framework is clearly outlined. Keeping it on a separate sheet or alongside the case prompt helps you stay organized and focused on the solution.

5.1.4 Structured calculations

When you encounter numerical data, take your time and plan your calculations before diving in. Interviewers value your logic and approach more than raw speed. Before starting, write down the steps you need to perform the calculation. Here’s an example:

- 1. Calculate current profits: Profits = Revenues - (Variable costs + Fixed costs)

- 2. Calculate the reduction in variable costs: Variable costs x 0.9

- 3. Calculate new profits: New profits = Revenues - (New variable costs + Fixed costs)

Make sure to demonstrate a structured approach before executing the calculations on a scrap sheet, then fill in the final results.

5.2. Common business knowledge and formulas

Although some consulting firms claim they don’t evaluate candidates based on their business knowledge, familiarity with basic business concepts and formulae is very useful in terms of understanding the case studies you are given in the first instance and drawing inspiration for structuring and brainstorming.

If you are coming from a business undergrad, an MBA or are an experienced hire, you might well have this covered already. For those coming from a different background, it may be useful to cover some.

Luckily, you don’t need a degree-level understanding of business to crack case interviews , and a lot of the information you will pick up by osmosis as you read through articles like this and go through cases.

However, some things you will just need to sit down and learn. We cover everything you need to know in some detail in our Case Academy Course course. However, some examples here of things you need to learn are:

- Basic accounting (particularly how to understand all the elements of a balance sheet)

- Basic economics

- Basic marketing

- Basic strategy

Below we include a few elementary concepts and formulae so you can hit the ground running in solving cases. We should note that you should not memorise these and indeed a good portion of them can be worked out logically, but you should have at least some idea of what to expect as this will make you faster and will free up much of your mental computing power. In what follows we’ll tackle concepts that you will encounter in the private business sector as well as some situations that come up in cases that feature clients from the NGO or governmental sector.

5.2.1 Business sector concepts

These concepts are the bread and butter of almost any business case so you need to make sure you have them down. Naturally, there will be specificities and differences between cases but for the most part here is a breakdown of each of them.

5.2.1.1. Revenue

The revenue is the money that the company brings in and is usually equal to the number of products they sell multiplied to the price per item and can be expressed with the following equation:

Revenue = Volume x Price

Companies may have various sources of revenue or indeed multiple types of products, all priced differently which is something you will need to account for in your case interview. Let’s consider some situations. A clothing company such as Nike will derive most of their revenue from the number of products they sell times the average price per item. Conversely, for a retail bank revenue is measured as the volume of loans multiplied by the interest rate at which the loans are given out. As we’ll see below, we might consider primary revenues and ancillary revenues: in the case of a football club, we might calculate primary revenues by multiplying the number of tickets sold by the average ticket price, and ancillary revenues those coming from sales of merchandise (similarly, let’s say average t-shirt price times the number of t-shirts sold), tv rights and sponsorships.

These are but a few examples and another reminder that you should always aim to ask questions and understand the precise revenue structure of the companies you encounter in cases.

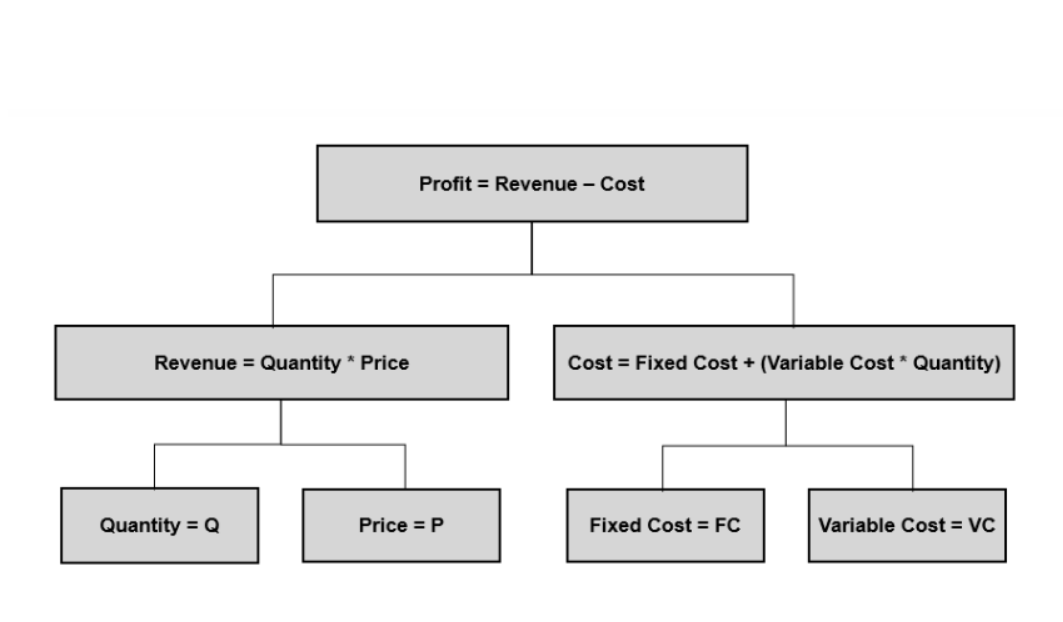

5.2.1.2. Costs

The costs are the expenses that a company incurs during its operations. Generally, they can be broken down into fixed and variable costs:

Costs = Fixed Costs + Variable Costs

As their name implies, fixed costs do not change based on the number of units produced or sold. For example, if you produce shoes and are renting the space for your factory, you will have to pay the rent regardless of whether you produce one pair or 100. On the other hand, variable costs depend on the level of activity, so in our shoe factory example they would be equivalent to the materials used to produce each pair of shoes and would increase the more we produce.

These concepts are of course guidelines used in order to simplify the analysis in cases, and you should be aware that in reality often the situation can be more complicated. However, this should be enough for case interviews. Costs can also be quasi-fixed, in that they increase marginally with volume. Take the example of a restaurant which has a regular staff, incurring a fixed cost but during very busy hours or periods they also employ some part-time workers. This cost is not exactly variable (as it doesn’t increase with the quantity of food produced) but also not entirely fixed, as the number of extra hands will depend on how busy the restaurant is. Fixed costs can also be non-linear in nature. Let’s consider the rent in the same restaurant: we would normally pay a fixed amount every month, but if the restaurant becomes very popular we might need to rent out some extra space so the cost will increase. Again, this is not always relevant for case interviews.

5.2.1.3. Profit and profit margin

The profit is the amount of money a company is left with after it has paid all of its expenses and can be expressed as follows:

Profit = Revenue - Costs

It’s very likely that you will encounter a profitability issue in one of your case interviews, namely you will be asked to increase a company’s profit. There are two main ways of doing this: increasing revenues and reducing costs, so these will be the two main areas you will have to investigate. This may seem simple but what you will really need to understand in a case are the key drivers of a business (and this should be done through clarifying questions to the interviewer - just as a real consultant would question their client).

For example, if your client is an airline you can assume that the main source of revenue is sales of tickets, but you should inquire how many types of ticket the specific airline sells. You may naturally consider economy and business class tickets, but you may find out that there is a more premium option - such as first class - and several in-between options. Similarly to our football club example, there may be ancillary revenues from selling of food and beverage as well as advertising certain products or services on flights.

You may also come across the profit margin in case interviews. This is simply the percentage of profit compared to the revenue and can be expressed as follows:

Profit margin = Profit/Revenue x 100

5.2.1.4. Break-even point

An ancillary concept to profit, the break-even point is the moment where revenues equal costs making the profit zero and can be expressed as the following equation:

Revenues = Costs (Fixed costs + Variable costs)

This formula will be useful when you are asked questions such as ‘What is the minimum price I should sell product X?’ or ‘What quantity do I need to sell in order to recoup my investment?’. Let’s say in a case interview an owner of a sandwich store asks us to figure out how many salami and cheese salami sandwiches she needs to sell in order to break even. She’s spending $4 on salami and $2 for cheese and lettuce per sandwich, and believes she can sell the sandwiches at around $7. The cost of utilities and personnel is around $5000 per month. We could lay this all out in the break-even equation:

7 x Q (quantity) = (4+2) x Q + 5000 (variable + fixed costs)

By solving the equation we can figure out that she needs to sell 5000 sandwiches to break even.

In a different scenario, we may be asked to calculate the break-even price. Let’s consider our sandwich example and say our owner knows she has enough ingredients for about 5000 sandwiches per month but is not sure how much to sell them for. In that case, if we know our break-even equation, we can simply make the following changes:

P (price) x 5000 = (4+2) x 5000 + 5000

By solving the equation we get to the price of $7 per sandwich.

5.2.1.5. Market share and market size

We can also consider the market closely with profit, as in fact the company’s performance in the market is what drives profits. The market size is the total number of potential customers for a certain business or product, whereas the market share is the percentage of that market that your business controls (or could control, depending on the case).

There is a good chance you will have to estimate the market size in one of your case interviews and we get into more details on how to do that below. You may be asked to estimate this in either number of potential customers or total value. The latter simply refers to the number of customers multiplied by the average value of the product or service.

To calculate the market share you will have to divide the company’s share by the total market size and multiply by 100:

Market share = Company’s revenue/Total revenue of the market x 100

Note, though, that learning the very basics of business is the beginning rather than the end of your journey. Once you are able to “speak business” at a rudimentary level, you should try to “become fluent” and immerse yourself in reading/viewing/listening to as wide a variety of business material as possible, getting a feel for all kinds of companies and industries - and especially the kinds of problems that can come up in each context and how they are solved. The material put out by the consulting firms themselves is a great place to start, but you should also follow the business news and find out about different companies and sectors as much as possible between now and interviews. Remember, if you’re going to be a consultant, this should be fun rather than a chore!

5.3 Public sector and NGO concepts

As we mentioned, there will be some cases (see section 6.6 for a more detailed example) where the key performance indicators (or KPIs in short) will not be connected to profit. The most common ones will involve the government of a country or an NGO, but they can be way more diverse and require more thought and application of first principles. We have laid out a couple of the key concepts or KPIs that come up below

5.3.1 Quantifiability

In many such scenarios you will be asked to make an important strategic decision of some kind or to optimise a process. Of course these are not restricted to non-private sector cases but this is where they really come into their own as there can be great variation in the type of decision and the types of field.

While there may be no familiar business concepts to anchor yourself onto, a concept that is essential is quantifiability. This means, however qualitative the decision might seem, consultants rely on data so you should always aim to have aspects of a decision that can be quantified, even if the data doesn’t present itself in a straightforward manner.

Let’s take a practical example. Your younger sibling asks you to help them decide which university they should choose if they want to study engineering.

One way to structure your approach would be to segment the problem into factors affecting your sibling’s experience at university and experience post-university.

Within the

- Financials: How much are tuition costs and accommodation costs?

- Quality of teaching and research: How are possible universities ranked in the QS guide based on teaching and research?

- Quality of resources: How well stocked is their library, are the labs well equipped etc.?

- Subject ranking: How is engineering at different unis ranked?

- Life on campus and the city: What are the living costs in the city where the university is based? What are the extracurricular opportunities and would your sibling like to live in that specific city based on them?

Within the ‘out of uni’ category you might think about:

- Exit options: What are the fields in which your sibling could be employed and how long does it take the average student of that university to find a job?

- Alumni network: What percentage of alumni are employed by major companies?

- Signal: What percentage of applicants from the university get an interview in major engineering companies and related technical fields?

You will perhaps notice that all the buckets discussed pose quantifiable questions meant to provide us with data necessary to make a decision. It’s no point to ask ‘Which university has the nicest teaching staff?’ as that can be a very subjective metric.

5.3.1 Impact

Another key concept to consider when dealing with sectors other than the private one is how impactful a decision or a line of inquiry is on the overarching issue, or whether all our branches in our issue tree have a similar impact. This can often come in the form of impact on lives, such as in McKinsey’s conservation case discussed below, namely how many species can we save with our choice of habitat.

5.4 Common consulting concepts

Consultants use basic logic business on an every day basis, as they help them articulate their frameworks to problems. However, they also use some consulting specific logical principles to quality check their analysis and perform in the most efficient way possible. These principles can be applied to all aspects of a consultant’s work, but for brevity we can say they mostly impact a consultant’s systematic approach and communication - two very important things that are also tested in case interviews. Therefore, it’s imperative that you not only get to know them, but learn how and when to use them as they are at the very core of good casing. They are MECE-ness, the Pareto Principle and the Pyramid principle and are explained briefly below - you should, however, go on to study them in-depth in their respective articles.

5.4.1 MECE

Perhaps the central pillar of all consulting work and an invaluable tool to solve cases, MECE stands for Mutually Exclusive and Collectively Exhaustive. It can refer to any and every aspect in a case but is most often used when talking about structure. We have a detailed article explaining the concept here , but the short version is that MECE-ness ensures that there is no overlap between elements of a structure (i.e. the Mutually Exclusive component) and that it covers all the drivers or areas of a problem (Collectively Exhaustive). It is a concept that can be applied to any segmentation when dividing a set into subsets that include it wholly but do not overlap.

Let’s take a simple example and then a case framework example. In simple terms, when we are asked to break down the set ‘cars’ into subsets, dividing cars into ‘red cars’ and ‘sports cars’ is neither mutually exclusive (as there are indeed red sports cars) nor exhaustive of the whole set (i.e. there are also yellow non-sports cars that are not covered by this segmentation). A MECE way to segment would be ‘cars produced before 2000’ and ‘cars produced after 2000’ as this segmentation allows for no overlap and covers all the cars in existence.

Dividing cars can be simple, but how can we ensure MECEness in a case-interview a.k.a. a business situation. While the same principles apply, a good tip to ensure that your structure is MECE is to think about all the stakeholders - i.e. those whom a specific venture involves.

Let’s consider that our client is a soda manufacturer who wants to move from a business-to-business strategy, i.e. selling to large chains of stores and supermarkets, to a business-to-consumer strategy where it sells directly to consumers. In doing so they would like to retrain part of their account managers as direct salespeople and need to know what factors to consider.

A stakeholder-driven approach would be to consider the workforce and customers and move further down the issue tree, thinking about individual issues that might affect them. In the case of the workforce, we might consider how the shift would affect their workload and whether it takes their skillset into account. As for the customers, we might wonder whether existing customers would be satisfied with this move: will the remaining B2B account managers be able to provide for the needs of all their clients and will the fact that the company is selling directly to consumers now not cannibalise their businesses? We see how by taking a stakeholder-centred approach we can ensure that every single perspective and potential issue arising from it is fully covered.

5.4.2 The Pareto Principle

Also known as the 80/20 rule, this principle is important when gauging the impact of a decision or a factor in your analysis. It simply states that in business (but not only) 80% of outcomes come from 20% of causes. What this means is you can make a few significant changes that will impact most of your business organisation, sales model, cost structure etc.

Let’s have a look at 3 quick examples to illustrate this:

- 80% of all accidents are caused by 20% of drivers

- 20% of a company’s products account for 80% of the sales

- 80% of all results in a company are driven by 20% of its employees

The 80/20 rule will be a very good guide line in real engagements as well as case interviews, as it will essentially point to the easiest and most straightforward way of doing things. Let’s say one of the questions in a case is asking you to come up with an approach to understand the appeal of a new beard trimmer. Obviously you can’t interview the whole male population so you might think about setting up a webpage and asking people to comment their thoughts. But what you would get would be a laundry list of difficult to sift through data.

Using an 80/20 approach you would segment the population based on critical factors (age groups, grooming habits etc.) and then approach a significant sample size of each (e.g. 20), analysing the data and reaching a conclusion.

5.4.3 The Pyramid Principle

This principle refers to organising your communication in a top-down, efficient manner. While this is generally applicable, the pyramid principle will most often be employed when delivering the final recommendation to your client. This means - as is implicit in the name - that you would organise your recommendation (and communication in general) as a pyramid, stating the conclusion or most important element at the top then go down the pyramid listing 3 supporting arguments and then further (ideally also 3) supporting arguments for those supporting arguments.

Let’s look at this in practice in a case interview context: your client is a German air-conditioning unit manufacturer who was looking to expand into the French market. However, after your analysis you’ve determined that the market share they were looking to capture would not be feasible. A final recommendation using the Pyramid Principle would sound something like this: ‘I recommend that we do not enter the German market for the following three reasons. Firstly, the market is too small for our ambitions of $50 million. Secondly the market is heavily concentrated, being controlled by three major players and our 5 year goal would amount to controlling 25% of the market, a share larger than that of any of the players. Thirdly, the alternative of going into the corporate market would not be feasible, as it has high barriers to entry.Then, if needed, we could delve deeper into each of our categories

6. Building blocks

As we mentioned before, in your case interview preparation you will undoubtedly find preparation resources that claim that there are several standard types of cases and that there is a general framework that can be applied to each type of case. While there are indeed cases that are straightforward at least in appearance and seemingly invite the application of such frameworks, the reality is never that simple and cases often involve multiple or more complicated components that cannot be fitted into a simple framework.

At MCC we don’t want you to get into the habit of trying to identify which case type you’re dealing with and pull out a framework, but we do recognize that there are recurring elements in frameworks that are useful - such as the profitability of a venture (with its revenues and costs), the valuation of a business, estimating and segmenting a market and pricing a product.

We call these building blocks because they can be used to build case frameworks but are not a framework in and of themselves, and they can be shuffled around and rearranged in any way necessary to be tailored to our case. Hence, our approach is not to make you think in terms of case types but work from first principles and use these building blocks to build your own framework. Let’s take two case prompts to illustrate our point.

Bain Case Study Example

The first is from the Bain website, where the candidate is asked whether they think it’s a good idea for their friend to open a coffee shop in Cambridge UK (see the case here ). The answer framework provided here is a very straightforward profitability analysis framework, examining the potential revenues and potential costs of the venture:

While this is a good point to start for your case interview (especially taken together with the clarifying questions), we will notice that this approach will need more tailoring to the case - for example the quantity of coffee will be determined by the market for coffee drinkers in Cambridge, which we have to determine based on preference. We are in England so a lot of people will be drinking tea but we are in a university town so perhaps more people than average are drinking coffee as it provides a better boost when studying. All these are some much needed case-tailored hypotheses that we can make based on the initial approach.

Just by looking at this case we might be tempted to say that we can just take a profitability case and apply it without any issues. However, this generic framework is just a starting point and in reality we would need to tailor it much further in the way we had started to do in order to get to a satisfactory answer. For example, the framework for this specific case interview doesn’t cover aspects such as the customer’s expertise: does the friend have any knowledge of the coffee business, such as where to source coffee and how to prepare it? Also, we could argue there may be some legal factors to consider here, such as any approvals that they might need from the city council to run a coffee shop on site, or some specific trade licences that are not really covered in the basic profitability framework.

McKinsey Case Study Example

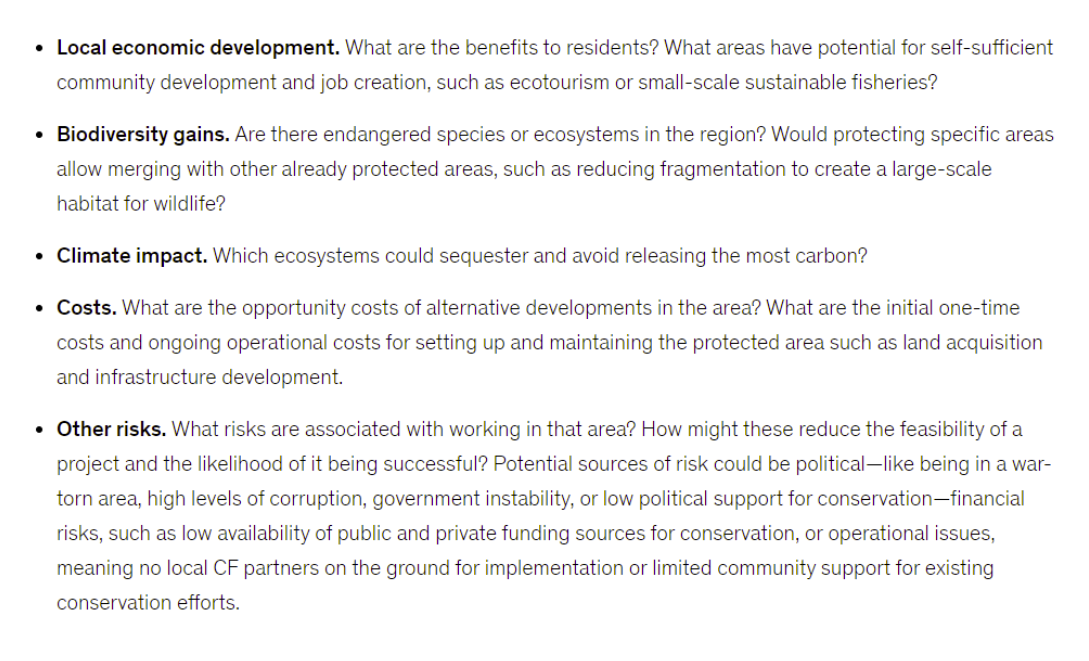

Let’s take a different case, however, from the McKinsey website. In this scenario, the candidate is being asked to identify some factors in order to choose where to focus the client’s conservation efforts. Immediately we can realise that this case doesn’t lend itself to any pre-packaged framework and we will need to come up with something from scratch - and take a look at McKinsey’s answer of the areas to focus on:

We notice immediately that this framework is 100% tailored to the case - of course there are elements which we encounter in other cases, such as costs and risks but again these are applied in an organic way. It’s pretty clear that while no standard framework would work in this case, the aforementioned concepts - costs and risks - and the way to approach them (a.k.a building blocks) are fundamentally similar throughout cases (with the obvious specificities of each case).

In what follows, we’ll give a brief description of each building block starting from the Bain example discussed previously, in order to give you a general idea of what they are and their adaptability, but you should make sure to follow the link to the in-depth articles to learn all their ins and outs.

6.1 Estimates and segmentation

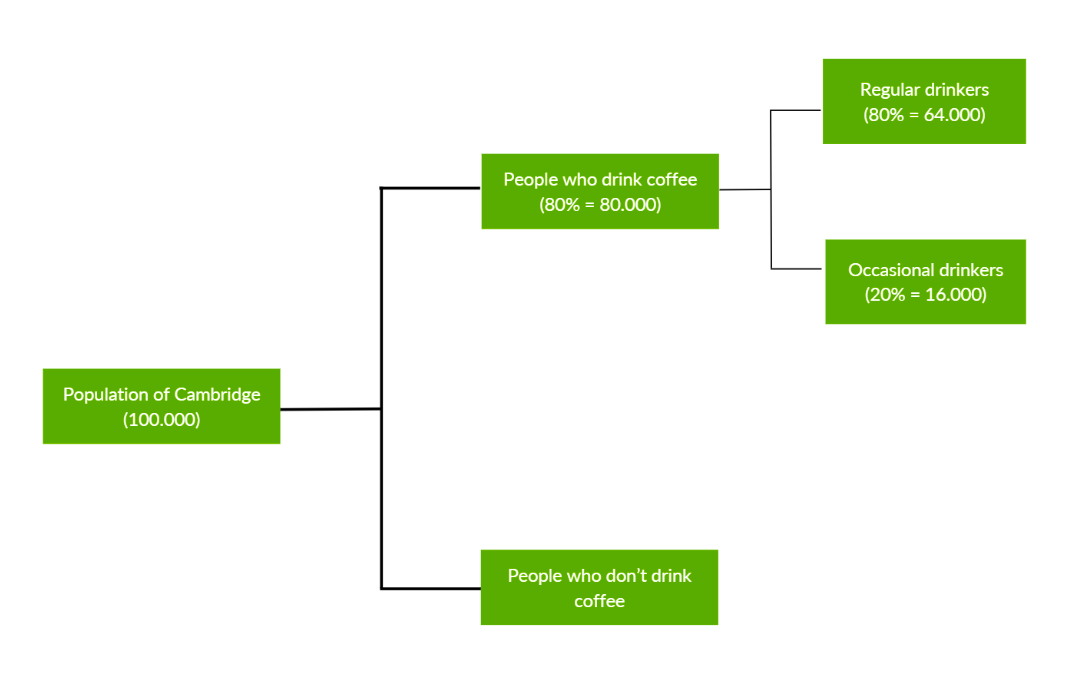

This building block will come into play mostly when you’re thinking about the market for a certain product (but make sure to read the full article for more details). Let’s take our Bain Cambridge coffee example. As we mentioned under the quantity bucket we need to understand what the market size for coffee in Cambridge would be - so we can make an estimation based on segmentation.

The key to a good estimation is the ability to logically break down the problem into more manageable pieces. This will generally mean segmenting a wider population to find a particular target group. We can start off with the population of Cambridge - which we estimate at 100.000. In reality the population is closer to 150.000 but that doesn’t matter - the estimation has to be reasonable and not accurate, so unless the interviewer gives you a reason to reconsider you can follow your instinct. We can divide that into people who do and don’t drink coffee. Given our arguments before, we can conclude that 80% of those, so 80.000 drink coffee. Then we can further segment into those who drink regularly - let’s say every day - and those who drink occasionally - let’s say once a week. Based on the assumptions before about the student population needing coffee to function, and with Cambridge having a high student population, we can assume that 80% of those drinking coffee are regular drinkers, so that would be 64.000 regular drinkers and 16.000 occasional drinkers. We can then decide whom we want to target what our strategy needs to be:

This type of estimation and segmentation can be applied to any case specifics - hence why it is a building block.

6.2 Profitability

We had several looks at this building block so far (see an in-depth look here ) as it will show up in most case interivew scenarios, since profit is a key element in any company’s strategy. As we have seen, the starting point to this analysis is to consider both the costs and revenues of a company, and try to determine whether revenues need to be improved or whether costs need to be lowered. In the coffee example, the revenues are dictated by the average price per coffe x the number of coffees sold, whereas costs can be split into fixed and variable.

Some examples of fixed costs would be the rent for the stores and the cost of the personnel and utilities, while the most obvious variable costs would be the coffee beans used and the takeaway containers (when needed). We may further split revenues in this case into Main revenues - i.e. the sales of coffee - and Ancillary revenues, which can be divided into Sales of food products (sales of pastries, sandwiches etc., each with the same price x quantity schema) and Revenues from events - i.e renting out the coffee shop to events and catering for the events themselves. Bear in mind that revenues will be heavily influenced by the penetration rate, i.e. the share of the market which we can capture.

6.3 Pricing

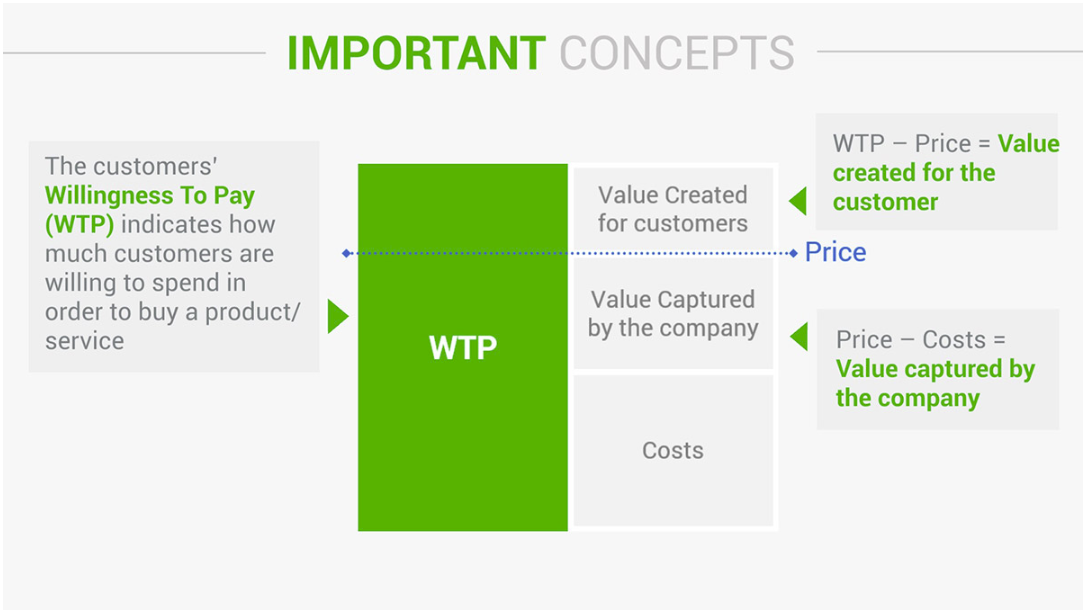

Helping a company determine how much they should charge for their goods or services is another theme that comes up frequently in cases. While it may seem less complicated than the other building blocks, we assure you it’s not - you will have to understand and consider several factors, such as the costs a company is incurring, their general strategic positioning, availability, market trends as well as the customers’ willingness to pay (or WTP in short) - so make sure to check out our in-depth guide here.

In our example, we may determine that the cost per cup (coffee beans, staff, rent) is £1. We want to be student friendly so we should consider how much students would want to pay for a coffee as well as how much are competitors are charging. Based on those factors, it would be reasonable to charge on average £2 per cup of coffee. It’s true that our competitors are charging £3 but they are targeting mostly the adult market, whose willingness to pay is higher, so their pricing model takes that into account as well as the lower volume of customers in that demographic.

6.4. Valuation

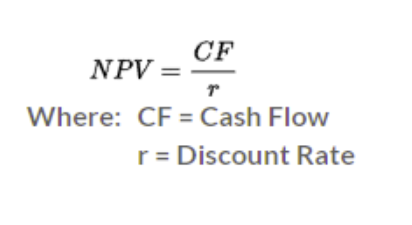

A variant of the pricing building block, a valuation problem generally asks the candidate to determine how much a client should pay for a specific company (the target of an acquisition) as well as what other factors to consider. The two most important factors (but not the only ones - for a comprehensive review see our Valuation article) to consider are the net present value (in consulting interviews usually in perpetuity) and the synergies.

In short, the net present value of a company is how much profit it currently brings in, divided by how much that cash flow will depreciate in the future and can be represented with the equation below:

The synergies refer to what could be achieved should the companies operate as one, and can be divided into cost and revenue synergies.

Let’s expand our coffee example a bit to understand these. Imagine that our friend manages to open a chain of coffee shops in Cambridge and in the future considers acquiring a chain of take-out restaurants. The most straightforward example of revenue synergies would be cross-selling, in this case selling coffee in the restaurants as well as in the dedicated stores, and thus getting an immediate boost in market share by using the existing customers of the restaurant chain. A cost synergy would be merging the delivery services of the two businesses to deliver both food and coffee, thus avoiding redundancies and reducing costs associated with twice the number of drivers and vehicles.

6.5. Competitive interaction

This component of cases deals with situations where the market in which a company is operating changes and the company must decide what to do. These changes often have to do with a new player entering the market (again for more details make sure to dive into the Competitive Interaction article).

Let’s assume that our Cambridge coffee shop has now become a chain and has flagged up to other competitors that Cambridge is a blooming market for coffee. As such, Starbucks has decided to open a few stores in Cambridge themselves, to test this market. The question which might be posed to a candidate is what should our coffee chain do. One way (and a MECE one) to approach the problem is to decide between doing something and doing nothing. We might consider merging with another coffee chain and pooling our resources or playing to our strengths and repositioning ourselves as ‘your student-friendly, shop around the corner’. Just as easily we may just wait the situation out and see whether indeed Starbucks is cutting into our market share - after all, the advantages of our product and services might speak for themselves and Starbucks might end up tanking. Both of these are viable options if argued right and depending on the further specifics of the case.

6.6. Special cases

Most cases deal with private sectors, where the overarching objective entails profit in some form. However, as hinted before, there are cases which deal with other sectors where there are other KPIs in place. The former will usually contain one or several of these building blocks whereas the latter will very likely have neither. This latter category is arguably the one that will stretch your analytical and organisational skills to the limit, since there will be very little familiarity that you can fall back on (McKinsey famously employs such cases in their interview process).

So how do we tackle the structure for such cases? The short answer would be starting from first principles and using the problem driven structure outlined above, but let’s look at a quick example in the form of a McKinsey case:

The first question addressed to the candidate is the following:

This is in fact asking us to build a structure for the case. So what should we have in mind here? Most importantly, we should start with a structure that is MECE and we should remember to do that by considering all the stakeholders. They are on the one hand the government and affiliated institutions and on the other the population. We might then consider which issues might arise for each shareholder and what the benefits for them would be, as well as the risks. This approach is illustrated in the answer McKinsey provides as well:

More than anything, this type of case shows us how important it is to practise and build different types of structures, and think about MECE ways of segmenting the problem.

7. How Do I prepare for case interviews

In consulting fashion, the overall preparation can be structured into theoretical preparation and practical preparation, with each category then being subdivided into individual prep and prep with a partner.

As a general rule, the level and intensity of the preparation will differ based on your background - naturally if you have a business background (and have been part of a consulting club or something similar) your preparation will be less intensive than if you’re starting from scratch. The way we suggest you go about it is to start with theoretical preparation, which means learning about case interviews, business and basic consulting concepts (you can do this using free resources - such as the ones we provide - or if you want a more through preparation you can consider joining our Case Academy as well).

You can then move on to the practical preparation which should start with doing solo cases and focusing on areas of improvement, and then move on to preparation with a partner, which should be another candidate or - ideally - an ex-consultant.

Let’s go into more details with respect to each type of preparation.

7.1. Solo practice

The two most important areas of focus in sole preparation are:

- Full cases

- Mental math