We have dealt with how to understand the competitive landscape in other articles on this site - including those on pricing, valuation and strategy. However, in those articles, we did not account for the ability of that competitive landscape to change over time. In fact, though, markets can change rapidly, and companies must work out how to change with it if they are to avoid going bust. Companies which fail to respond adequately to changes in the competitive landscape can go from dominating the market to irrelevance or bankruptcy overnight. Remember when everyone you knew owned a Nokia? How many do you see these days?

Deciding how exactly a company should respond can be a highly complex business, and consultants will often find themselves called in to advise. The fact that competitive reaction is a recurring theme in day-to-day consulting work means it is also very likely to come up in your case interview. If you want to land your dream job in consulting, then, you should make sure this is a topic you are very comfortable dealing with!

What to do?

So, how should we react when the competitive landscape changes? As always in consulting, our first step should be to understand precisely what the problem we are dealing with is.

Any market is constituted by a complex web of interactions between the various competing companies, customers and external influences, meaning that there will be an indefinite number of ways in which changes can happen. Indeed, if it was possible to draw up an exhaustive play book covering all possible changes to a competitive landscape as well as how to respond to them, companies would never go bust and we'd all still be playing snake on Nokia 3210's.

Looking for an all-inclusive, peace of mind program?

Choose our mentoring programs to get access to all our resources, a customised study plan and a dedicated experienced MBB mentor Learn moreHowever, this is not to say - first - that certain forms of market change will not recur and - second - that there are not aspects of our response which will be the same across different cases.

In light of this, we will first go through some of the more common ways in which markets can change, before discussing the fundamental options we have available to us in response to any such change.

1. Understand the Change

Let's examine three common ways in which the competitive landscape might change to the detriment of a company.

Increase in Competition

Your company might experience increased competition either from new market entrants of from the growth of existing market players. Companies might gain competitive advantages via various different strategies.

To understand why another company is outcompeting our own, we need to understand how they are positioning themselves in the market and how this relates to our own positioning.

Let's look at a few common strategies which industry players might adopt:

1. Price Players

These companies compete on price, offering the lowest prices in the market by adopting a low cost production structure. Price players will attract cost-sensitive customers, and might trigger an industry-wide price war.

2. Differentiated Quality Players

Not all companies compete on price. Others offer "differentiated" products, with additional features which customers are willing to pay a higher price for. For example, low-cost airlines like Ryanair versus more premium airlines like British Airways. You should refer to our article on pricing for a more comprehensive discussion of how differentiation can support higher prices.

3. Convenience Players

Differentiated products are not the only way to support higher prices. Companies can also focus on satisfying the "here-and-now" needs of customers by selling standard-quality products at a higher price supported by convenience. The familiar example here is of small convenience stores selling groceries and related items. These maintain significantly larger prices than larger superstores, but which are still favoured by customers for their ease of use.

4. Stuck-in-the-Middle Players

It is unlikely that you will be threatened by this kind of company. Rather, if your company is losing out to competitors, it is more likely that your firm is stuck-in-the-middle itself. Such companies often respond to competition from successful specialised players by trying to appeal to everyone. However, this is a recipe for failure, as it means not excelling in any one dimension. In the UK, Marks and Spencer has sometimes suffered from this problem, seeing its profits stagnate whilst both discount and higher-end competitors show strong growth.

Join thousands of other candidates cracking cases like pros

At MyConsultingCoach we teach you how to solve cases like a consultant Get startedM&A

Mergers and acquisitions can have profound effects on the competitive environment. We can separate two broad types of M&A move:

-

Vertical M&AVertical M&A means purchasing or merging with companies either above or below on the value chain. This provides a variety of options to improve market share via outcomes like improving reducing costs, reducing uncertainty or other benefits. For example, an online retailer might decide to purchase a courier company to deliver its products more cheaply. Alternatively, for a manufacturer, purchasing a supplier might reduce raw material costs whilst also reducing any uncertainties in supply and possibly even depriving competitors of their own supplies.

-

Horizontal M&AHorizontal M&A involves merging with or acquiring one or more market competitors. This might make the newly unified entity more competitive via various synergies, including saving on costs by economies of scale and eliminating duplicated structures and gaining revenue by cross selling products. For a more detailed discussion of such synergies, refer to our article on pricing

Increase in Supplier Power

Sometimes, the competitive landscape will be altered by a reduction in the number of suppliers. This might be the result of bankruptcies or M&A, but the end result is the same in that the remaining suppliers are able to command higher prices and thus drive down our firm's profits.

Forget outdated, framework-based guides...

Interviewers are sick of seeing candidates miss the point and make the same old mistakes. Stand out from the crowd by learning to think like a working consultant! Get started2. Decide on a Solution

The world is a harsh place. There might be any number of ways in which a market can change that might hurt your business, but your options in responding to these challenges are inherently constrained.

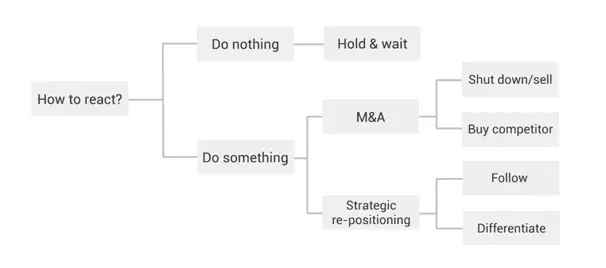

The broad options available are captured in the structure below, showing the basic decisions which must be faced by any company in a changing competitive environment.

Note: This is not a structure to be blindly applied as-is in any case you encounter which features competitive reaction - we at MCC are not in the business of peddling generic frameworks. With competition, just like any other case, you must tailor your approach to demands of the specific scenario.

Let's consider the options shown in this structure in turn:

Hold and Wait

It is easy to assume that we must react to a changing market - and companies will often fall into this trap themselves. However, there are many cases where the optimal strategy is simply to continue as before. This might be for a couple of different reasons.

One reason not to act is because the change in competitive landscape is expected only to be temporary. For example, General Motors might not be worried about short term losses of market share to Tesla if they reckon that the smaller company's financing is not sustainable. If they were correct, it would be a waste of money to take steps against Tesla now, rather than simply waiting for them to fail.

Everything you need in one place

All the most up-to-date resources delivered as a MBA course Learn moreBeyond this, though, even where changes to the landscape are expected to be more permanent, it might not actually be possible or sensible to respond. If the response required to regain lost revenue would cost more than the actual value of that revenue, then it does not make sense to act. Alternatively, even if a response had the potential to yield a positive net return, its cost might exceed the company's available cash reserves or ability to obtain finance. In this case the company will simply have to accept its contracted market share - at least for the time being.

Respond

Assuming that a response is both feasible and worthwhile, we then need to decide on the character of that response. Broadly, we can divide possible responses into two types. Let's look at each in turn:

M&A

One way to respond is by undertaking M&A. There are a two main ways in which we can respond to competition via M&A:

-

Sell UpRealistically, it might not be possible to salvage your company's position within the market. Imagine you got into minidisc manufacturing just as MP3 was emerging (or were the proprietor of the Pony Express when the telegraph was rolled out). If the company is no longer profitable and there is no prospect for it to be so, then it makes sense to sell up and get out of the industry before running up debts trying to flog a dead horse.

-

Buy the CompetitorAlternatively, we might simply buy our competitor and remove the problem before they have time to damage us further. This kind of response to competition has been especially well reported in the tech industry in recent years, where dominant market players will buy up new competitors before the smaller companies can grow to challenge their position. Thus, we have seen the purchase of Whatsapp and Instagram by Facebook, preventing these similar products from eventually posing an existential threat to Facebook's core business.

Change Positioning

Imagine you are running an airline and face the same challenge as many in that position will have done in the past couple of decades, when a low cost carrier like Easyjet or Ryanair start serving routes in your market. You are losing customers to their lower fares. M&A solutions are not suitable and you decide to respond by changing your market position.

You have two broad options:

-

FollowYou can decide to follow your competitor's positioning to compete on the same terms. Thus, you decide that your airline should also be a low cost carrier and set about removing frills and paring down service to lower costs and thus keep prices similar to or lower than the new market entrant. In the language from our article on pricing, you decide to compete by pursuing a cost advantage.

-

DifferentiateOtherwise, you can seek to hold on to market share by differentiating your offering and seeking to specialise in a different market segment to that of your competitor - carving out a different niche for your company. Thus, you set about targeting customers willing to pay more for a higher quality service by increasing overall levels of quality and improving your business class and first class offerings.

Takeaway

This article has given you a good idea of the issues faced by companies when their competitive environment changes. We have run through some of the ways these changes can happen, as well as the general options which are available to companies to respond.

This is a good primer on competitive reactions. However, to be able to reliably tackle more complicated case studies focussed on this issue, you will need to take your learning further than the format of this short article allows. For more detail on all the theory we have discussed as well as a full, worked case example focussing on response to competition, the best available resource is our full length video on competitive reaction in the "building blocks" section of the MCC Academy.

Of course, competitive reaction isn't the only recurring issue in consulting case interviews. There are a few kinds of problem which working consultants face again and again - and thus which are likely to come up in some form in your case interview. As such, if you haven't already, you should make sure to check out our other "building blocks" articles on common themes such as pricing, valuation, estimation and profitability. As always, the MCC Academy provides the ultimate resource for these "building blocks", as well as all aspects of prep for your case and fit interviews.

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.