why a deep understanding of costs is crucial

The importance of costs is often underestimated in business decisions. Also, candidates tend to consider them as simple and intuitive. Costs in themselves are not a difficult concept, but identifying the best cost structure and projecting its long term implications can be a daunting challenge. After all, an unsustainable cost structure is the main reason why companies end up going out of business. And not surprisingly, many consulting projects end up being about reducing and managing costs.

We structured this chapter in two sections:

- ESSENTIALS: Key concepts and implications of cost structure all candidates should be familiar with. While most candidates have a basic grasp of the basics, we constantly find out that very few are aware of the implications of different cost structures on present and future profitability

- ADD-ONS: Additional concepts all interviewers should be familiar with by their interview day, but not essential to start practising. We suggest going through them after some practice and with a solid understanding of the ESSENTIALS

We strongly suggest you bookmark this page, since it is the most comprehensive resource on cost structure you can find on the market.

Just click on the concept you want to expand to learn more!

Essentials

THE BASICS OF COST STRUCTURE

Fixed costs are the costs that occur on a regular basis and do not depend on quantities produced. Examples are:

- Administrative costs

- Depreciation of fixed assets (e.g. machinery, property, plant equipment)

- Labour (when not dependent on quantities sold)

Variable costs instead vary according to the level of activity and they include:

- Raw materials

- Labour (when dependent on quantities sold)

- Energy and other utilities

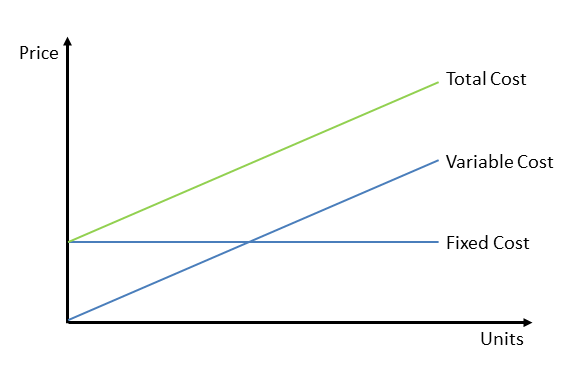

The graph below shows a typical cost function for a company.

Two main points emerge:

- When quantity is 0 total cost is equal to fixed costs

- For every additional unit, Total cost = fixed cost + variable cost x # of units

IMPLICATIONS OF COST STRUCTURE ON PROFITABILITY

High fixed cost businesses are highly dependent on high volume sales to make profits (e.g. airline industry). For example, if you have an airline with high fixed costs and low consumer demand, you will likely suffer losses. However high fixed cost base provides some potential advantages as well:

- Scalability: businesses with a high share of fixed costs can (sometimes) be more scalable: as long as there is enough capacity, revenues from more customers translate almost directly into higher profits

- Barrier to entry: a high initial fixed cost could build a strong competitive position, limiting competitors’ possibilities of entering the market. Sometimes initial fixed costs may be so high that it would be unprofitable for more than one player to bear them, as in Natural Monopolies, sectors when large-scale infrastructure is required to ensure supply (e.g. electric grid, water system)

Understanding the functioning and implications of the cost structure of a business is an essential ingredient in taking the right decisions. In general, a project or company should operate when it generates a profit, i.e. total revenue exceeds total costs (fixed+variable). However the impact of the cost structure will be different according to the phase of the company project and the setting. The 2 key differentiators are whether you are dealing with a short term or long term decision.

LONG TERM DECISIONS

Business decisions are considered “long term” in two situations:

- Active company planning for the future: When a company is operational and has the opportunity to change its cost structure or withdraw from some businesses. Obviously, since the company is not committed to any operational levels, i.e. fixed costs, the decisions should be based solely on profitability, i.e. the difference between total revenues and total costs.

- Investment decision: a setting where you have not committed any capital yet. Your decision criterion is essentially whether you can get an adequate return on your capital, or, to put it more simply, whether the returns you get from investing your capital exceed the investment costs.

Consider the example below:

You are helping the CEO of Disneyland to evaluate the project of launching an amusement park. What would be the key criteria to assess whether it is a good idea?

All key attractions of an amusement park, including carousels and rollercoasters, are fixed upfront costs. An amusement park is clearly a fixed costs business. The decision to open a park depends on whether the future stream of revenues (for the life of the installed attractions) will exceed the initial fixed costs and the running costs. In other words, assuming that attractions last for about 20 years and zero discount rate:

∑ revenues (years 1 to 20) > attraction purchase and installation + ∑ attractions running costs (years 1 to 20)

Fixed costs play a decisive role in the decision: if they are too high, i.e. they exceed the sum of revenues and running costs, then creating the park becomes unprofitable and our client would be much better off by not launching the park at all. You could potentially sophisticate the equation further by adding a discount rate: since your returns will be spread across 20 years and your investment in fixed costs will be immediate you should discount the value of the former by an appropriate rate that reflects the risk of the amusement park sector.

SHORT TERM DECISIONS

The scenario changes dramatically when you have already launched the business and you have no chance of changing your fixed cost structure through sales/investment/divestment/exit. Once you have already completed the initial investment, all your decisions will not be related to investments but to revenue maximization, and maximizing revenues is usually equivalent to setting the right price. Consider the below example:

You are flying a 100-seat plane from London to Marbella and you have the following cost structure:

- Fixed costs: airplane maintenance, fuel, crew: 5.000$/flight

- Variable costs: food, handling, ticketing: 10$/ passenger

Knowing that a low cost competitor has just entered the market pricing aggressively at 30$/ticket, would it make sense to match the competitor’s price?

It would be tempting to simply conclude that the minimum price per ticket would be given the breakeven point taking both fixed and variable costs into the equation, i.e.

5.000/100 + 10 = 60$

However this is fundamentally wrong. If you have already launched the airline and have no chance to change the route, you should only take variable costs in establishing your minimum price that would be 10$. The idea is that every change is revenue generating when marginal revenue is greater than marginal cost. The intuition is as follows: if you have one additional (marginal) passenger paying 10.01 $ you are better off flying without that passenger: after all you would incur the fixed costs anyways and, as long as the passenger pays more than 10$, the additional revenue he generates (10.01$) exceeds the additional cost (10$). Two important points of caution:

- The above reasoning provides the lower-bound for the price, it does not mean that you should try to maximize your revenues by charging a higher price

- The idea of considering fixed costs as “sunk” and not taking them into account for pricing decisions only applies when a company has already committed to providing the service and does not have the opportunity to exit business. In other words, it applies for short term business decisions. Obviously, if the total cost base of a company is higher than total revenues, the best long term choice may be exiting the business

Add-ons

DEFINITION

Making a business decision in light of a number of choices is not usually an easy task. Some decisions will not be implemented, and opportunity cost is the measure of the profit forgone due to an unimplemented business decision. In a typical case study situation, a supermarket in a busy part of town has decided to use their adjoining plot of land as a car park. Before opening it, they have to consider whether or not to charge their customers for parking. If they decide to charge their customers, the benefits are additional revenue from ticket sales. However this decision has an opportunity cost, i.e. the lost profit from customers who might decide not to shop in the supermarket because of the parking tickets.

WHY OPPORTUNITY COST MUST BE CONSIDERED IN EVERY BUSINESS DECISION

At the end of the day, our actions, inactions or omission will all be considered as decisions. This is simply because they all lead to costs since a business will have to forgo benefits of alternative decisions. In this regard, it is crucial to always rank your alternatives and pick the one with the highest expected return, given by

Return (profit) from taking a decision – opportunity cost (lost profit) from the best forgone opportunity (the one with the highest return)

BUSINESS CASE SCENARIO (INVESTMENT)

Mr. Albert has $500,000 he could invest at a 10% yearly return which translates to a $50,000 annual profit. If he decides not to invest the amount, what will be his opportunity cost?

Options and Implications

Mr. Albert will have his $500,000 after a year if he decides not to invest the money. By this, the amount in his account after a year of not investing will be $500,000 as against $550,000 if he decides to invest the said amount. His opportunity cost will, therefore, be $50,000.

BUSINESS CASE SCENARIO (PRODUCTION)

Mr. Jacob could decide to invest his money into a timber logging business, and the cost of producing a 1m length of wood is $20, which then will be sold to furniture makers at $24 per meter ($4 profit). But since he is already producing the raw materials, Jacob felt it would be a wise business decision to start a furniture company. With 1m of wood, his furniture business creates desks and chairs for school children which he retails at $203 per pair of chair and desk, after producing the pair at $191 ($12 profit). What will be the opportunity cost for this business decision?

Options and Implications

The cost of the opportunity forgone by not selling the 1m length of timber is $4 (lost profit). The next thing will be to determine if the idea is profitable or not. The new model will fetch a $12 profit. If you deduct the $4 opportunity cost from the logging business, the profitability of the company will be $8.

ECONOMIES OF SCALE

This is a measure of a company’s savings in costs due to their high production output. It could be realized in the following forms:

Fixed/overhead cost

- A company will be able to spread and reduce fixed costs like salaries or equipment rent over a larger output.

- Overhead costs such as energy cost would be spread over a larger output

Variable costs

- Larger sizes of raw materials and production technologies, resulting in bulk discounts

- Risks are distributed on a larger scale, leading to less demand peaks

ECONOMIES OF SCOPE

Even though the economies of scope are distinct from the economies of scale, the bottom line is that they both help to reduce cost. While the concept of scale is designed to reduce the unit cost of a product, economics of scope contributes to reducing the overall cost because the products share a similar production process. Economies of scope are commonly caused by the following factors:

Clustering Effect If an organization has company branches around the same area, they could pass around equipment to be used in all branches.

Bundling effect Similar production processes can serve more than a single product which helps to spread the costs.

INTRODUCTION

The net present value (NPV) determines how much future money is worth today. Based on this valuation, it will be possible to evaluate projects or investments based on envisaged cashflows. This enables us for example to compare businesses based on the future cash flows, that are going to be generated. While the concept of cash flow is different from profitability, normally for consulting interviews you can assume future profits to be a reasonable approximation of future cash flows.

The idea of discounting future cash flows with the NPV is that the value of money is inversely proportional to how far in the future you are receiving it. The concept is also known as time value of money and we provide two explanations below:

- Intuitive explanation: It is better to have $5000 now than to have the same amount in 5 years’ time. There’s a risk that in 5 years time you might not get anything. Moreover, if you receive the money now you have the decision to keep, invest, or spend it.

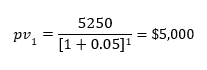

- Financial explanation: Assuming risk can be averted, what could $5000 worth in a year? If the money is fixed in a bank, interest will be earned. However, inflation might make you lose some money. Assuming a 5% inflation-adjusted interest rate, the amount could become $5,250 after a year. Conversely, if you have a future value of $5,250 in 1 year, how much is it worth today? $5250/1.05=$5,000.

CALCULATING THE NPV

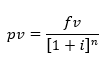

Given that:

- The present value is designated as PV Future value is given as FV

- The decimal value of the interest rate is i

- The number of periods between PV and FV (not necessarily in years) is n

In the given example, the PV of $5,250 over a 1 year period is

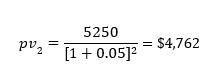

Subsequently, if the amount had been received in 2 years, the PV will be

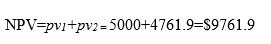

Therefore, the NPV of both $5250 payments for 1 and 2 years will be:

It’s unlikely that you will need to calculate a complex NPV during a case interviewbecause the calculations tend to get overly complicated. But, in some cases you can apply some shortcuts as discussed below

PERPETUITY

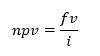

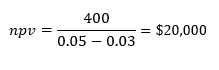

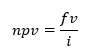

If a business will generate interests for an infinite number of years, the NPV for such cash flow can be calculated as:

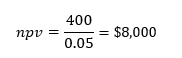

In order to value a company or business, it is usual to define the value of the company as the sum of all its discounted future profits. To calculate the NPV, it could be assumed that the firm will generate the same profit every year and equally expect the same discount rate. If you assume that a company will make a profit of $400 at 5% discount rate, the NPV can be calculated as such:

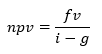

However, profits (usually) grow overtime. Therefore it can be better to have a more practicable growth rate (g), included in the formula below.

If we assume the growth rate to be 3% annually, the company’s NPV at a $400 profit (keeping the discount rate at 5%) a will be given by:

CALCULATING THE INTEREST RATE (i)

By implication of this formula

It could be inferred that the NPV is inversely proportional to the interest rate (or discount rate). That is, as the discount increases, the NPV will reduce. Higher discount rate i is set to compensate for an higher risk. In other words, the less you can be sure about receiving future earnings, the less you value them, or, if you put yourself in the shoes of the lender, the more you perceive the borrower as unsafe, the more interest you want. These are the most common interest rates:

- 1% to 3% for secure cash streams (e.g. government bonds)

- 5 to 10% for established companies

- 20+% for private equity investments

- 25+% for speculative start-up investments

However, there is no magic number, the right discount rate reflects the risk of your business and should be therefore linked to what investments in a similar business provide in terms of return on the bond market.

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.