The Watch Collector

You have a passion for vintage watches. You already have an extensive personal collection, but have found that you also buy an average of two watches per year to give as gifts, either to family members or business associates. Your knowledge of the marketplace and developing trends as to which models are particularly desirable has meant that, in the past, you have made good returns buying and selling watches, keeping pieces for a few years so that they appreciate in value. You enjoy this trading activity and would like to do more of it.

You have now had the idea that, as a hobby, you can make trading watches pay for your gift giving activities. As such, you decide to give over a safe at home to "trading watches" which you will buy in, keep for a number of years and sell on at a profit. Over time, you hope that this continuing enterprise will cover your gift giving and eventually yield a net profit.

Questions to Address

The candidate will need to make some approximate calculations to establish the following:

- How will the number of watches in the safe change over time?

- How do the costs and revenues of the enterprise vary over time? In particular, how long will it be until breaking even?

Sketched graphs should be generated to visualise this information.

Identify the Problem

To begin, the candidate should show awareness of the constraints on this enterprise.

The candidate should ask the following:

1. What do the watches cost?

Gift watches cost an average of £5k each, whereas trading watches are typically bought for £2k each.

2. What is the budget?

You will spend £20k on watches immediately to get the project started and thereafter put in £2.5k per month. This budget will be used to buy the required gift watches before all remaining funds are used to purchase trading watches.

3. How many watches are given as gifts?

Typically, you give two watches per year as gifts.

4. What is the expected rate of return on the trading watches?

Trading watches are expected to appreciate by 15% per annum. They are always sold after five years, with no trouble finding buyers and no costs (such as taxes) associated with the sale.

5. Are there costs associated with the enterprise? Buying the safe? Cleaning and/or maintain watches?

No. The safe was inherited and is currently underemployed. As an enthusiast, you are able to do a certain amount of basic cleaning etc yourself, with the cost of any more involved, professional work already priced into the quoted average cost of watches.

6. What is the capacity of the safe?

The safe is quite large currently holds only some paperwork and jewellery. There is space for up to 80 watches.

2. Leading the Analysis

With all the relevant information in hand, we can answer the two main questions above.

Watch Numbers Over Time

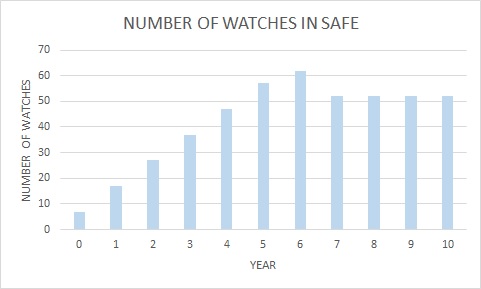

We start with the first question, as to how the number of watches in the safe will vary over time.

This wills also let us establish whether the number of watches to be stored at any one time will exceed the safe's capacity.

To answer this question, the candidate should supply a graph.

Calculations:

The starting investment (which we will consider as being Year 0) will buy the two gift-watches for the year for £10k, with the remaining funds buying 10/2 = 5 trading watches.

Thus, in year zero, we begin with two gift watches and five trading watches, for a starting total of seven watches in our safe.

In subsequent years, the safe will have £2.5k x 12 = £30k of watches placed within it, before any are removed for gifting or sale. Of this, the two gift watches are given away and replaced at a recurring cost of £10k. The remaining £20k buys 10 trading watches per year.

After five years, the five trading watches purchased initially are sold. From year six onwards, ten trading watches per year come up for sale.

Over the long term, an equilibrium develops whereby 52 watches held in the safe at any one time.

This is significantly less than the 80 watches which the safe can accommodate, so capacity will not be an issue.

The candidates graph should approximate Exhibit 1, shown below:

Costs and Revenues Over Time

Here, we consider the cumulative net costs and eventual profit over time.

Calculations

In Year 0, we spend our 20k stake and accrue no revenue.

Transactions from Years 1-4 are also entirely made up of spending - in that case by £30k per annum.

In Year 5, we spend 30k, but also sell 5 watches.

From Year 6 onwards, we spend 30k per annum, but also sell 10 watches each year.

These watches were bought at £2k each and have appreciated by 15% per annum.

The candidate can estimate the sale value of these watches as £4k each.

The actual sale value after compounded appreciation of 15% per annum will be £4022. However, the math involved to reach this value will likely be too involved for the candidate to complete in the available time. Instead, it is perfectly satisfactory for the candidate to estimate a value of £4k with the rationale that this value is a little higher than £3.5k, to quickly take approximate account of compounding.

From year six onwards, revenues exceed costs and the enterprise should break even at Year 20.

After year 20, we return a profit of £10k per year.

The candidate's graph should approximate Exhibit 2, below:

Discussion

The time taken for the enterprise to break even and for you to recover your investment and yield a profit is very long at 20 years. We would have to think very carefully if the idea is one we will have the time and resources to pursue over such a long period.

Indeed, this 20 year break-even point is already based on some very generous assumptions. Notably:

- Trading watches will always appreciate at an average of 15% per annum and that you will always be able to find buyers at these prices.

- You can afford to invest over £150k before seeing any returns.

These high returns might be plausible if we are able to identify and stay ahead of trends in the vintage watch market, but this will be very difficult to do reliably - especially as this is only a hobby enterprise and not a full time job. Just because we have done so occasionally in the past does not give us warrant to immediately assume we will make all the right judgements over a 20 year span.