Case

Ferret rabies vaccine

Case prompt

Pet Vaccines, Inc. (PVI) is an American pharmaceutical company that specializes in rabies vaccines for domesticated pets. Right now, PVI produces a rabies vaccine that works on both cats and dogs and has captured about 50% of market.

For the last 2 years, PVI scientists have been working on a vaccine that would also inoculate ferrets against the rabies virus. They have finally come up with the first proprietary formula that works on

cats, dogs, AND ferrets and are considering whether or not to introduce the new product into the market. If they launch the product, they will replace all current production with the new formula.

Ferret owners across the country have been waiting for a product like this to hit the market. You can assume that demand for the new vaccine from ferret owners will be extremely high.

Detailed solution

Paragraphs highlighted in orange indicate hints for you on how to guide the interviewee through the case.

Paragraphs highlighted in blue can be verbally communicated to the interviewee.

Paragraphs highlighted in green indicate diagrams or tables that can be shared in the “Information to share” section.

Suggested case structure

Key question: is the the estimated increased profit worth the investment for launching this new product?

-

Profitability:

estimate additional profit for the client with the new formula compared to the as-is scenario

- Revenues: estimate the size of the ferrets market and how much volume the client can expect to sell; identify the right price point based on similar products in the market (i.e. client’s pre-existing product line).

- Costs: understand the additional fixed and variable costs that go into manufacturing the vaccine with the new formula

- Investment: consider all costs to be incurred for starting to manufacture the new product; beware of sunk costs, which should not factor into your economic model.

If needed, share Exhibit 1 with the interviewee

1. Revenues

a. Sizing the market

The interviewee should inquire about the current pet rabies vaccine market. S/he can assume that each domesticated US pet is inoculated against rabies once in its life.

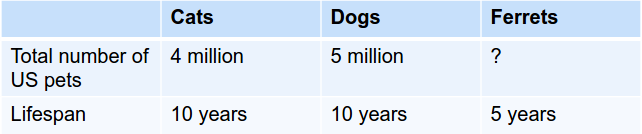

Share Exhibit 2 with the interviewee to estimate current and projected market sizes

{

Exhibit 2:

Cats and dogs are extremely popular in the United States, so it’s safe to assume that the ferret market is substantially smaller. Interviewee should make a reasonable assumption about the number of domesticated ferrets in the US. For ease of calculations, let’s assume there are 1 million domesticated ferrets in the US.

Since we know that our client captures roughly 50% of the pet rabies vaccine market, PVI currently delivers:

If our client were to introduce the new vaccine to serve ferrets as well:

Cats and dogs are extremely popular in the United States, so it’s safe to assume that the ferret market is substantially smaller. Interviewee should make a reasonable assumption about the number of domesticated ferrets in the US. For ease of calculations, let’s assume there are 1 million domesticated ferrets in the US.

Since we know that our client captures roughly 50% of the pet rabies vaccine market, PVI currently delivers:

50% * 4 million cats / 10 years + 50% * 5 million dogs / 10 years = 450,000 vaccines per year

If our client were to introduce the new vaccine to serve ferrets as well:

100% (since this is the first vaccine of it’s kind) * 1 million ferrets / 5 years = 200,000 vaccines per year.

Key insight

The new vaccine promises an increase of 200,000/450,000 = 44% in sales, which is substantial growth for our client.

b. Pricing

The interviewee should inquire about the current price of PVI’s vaccine

The current price of PVI’s cats and dogs vaccine is $4.50 to their customers and $20 to the end consumer

At this point, the interviewee should try to brainstorm who she thinks the customer is. She should come to the conclusion that customers are pet hospitals and other veterinarian clinics, while the end consumer is pet owners.

Next, the interviewee should think about value to the customer/end consumer and if this new vaccine offers any incremental value. Given that this new vaccine will replace the current product offering and the ferret market is relatively small, it’s safe to assume that most veterinarians would not be willing to pay a premium for the new vaccine (i.e. if ferret owners represent 10% of a veterinarian’s customers, he will not want to pay a mark-up on the 90% of vaccines he administers to cats and dogs).

Thus, the interviewee should determine that the price should remain at $4.50.

If the interviewee makes a logical argument for increasing the price (for a maximum 10% increase to remain competitive), acknowledge the argument but nudge them in the direction of maintaining the price.

Since we know the price and the volume, we can now calculate incremental revenues:

200,000 additional vaccines per year * $4.50 = $900,000 in incremental revenues each year

Key insight

$900,000 and 44% sales growth for our client sounds highly promising. However, without knowing the cost structure of the new vaccine, it is impossible to make a recommendation. *Note: the interviewee should not be distracted by the $20 price to the end consumer as this has no impact on our client’s distribution strategy.

2. Costs

The interviewee should inquire about costs of the current vaccine and new vaccine

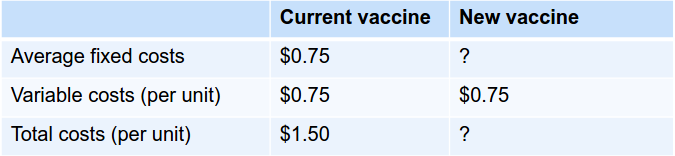

Total fixed costs will remain the same with the new vaccine. The current cost structure for the cats and dogs vaccine is as follows:

Share Exhibit 3 with the interviewee to estimate current and projected market sizes

Exhibit 3:

The interviewee should have several takeaways from this data before doing any calculations. If stuck, ask the interviewee what she can deduce from the table. Try to get her to the final takeaway so she knows how to proceed.

1. I see that variable costs per unit will remain the same with the new vaccine

2. It seems like the client is making a healthy profit margin on each sale given that the vaccine sells for $4.50. That is a profit margin of $3/$4.50 = 66%, which seems good for the pharmaceutical industry.

3. Knowing that total fixed costs will remain the same, I would like to calculate the new average fixed cost of each vaccine.

2. It seems like the client is making a healthy profit margin on each sale given that the vaccine sells for $4.50. That is a profit margin of $3/$4.50 = 66%, which seems good for the pharmaceutical industry.

3. Knowing that total fixed costs will remain the same, I would like to calculate the new average fixed cost of each vaccine.

In order to understand per unit cost and profitability, we must first calculate total fixed costs of the current product offering:

$0.75 (average fixed costs) * 450,000 vaccines (calculated previously) = $337,500

Thus, average fixed costs for the new product would be:

$337,500/(450,000 cat & dog vaccines + 200,000 ferret vaccines) = $0.52. Let’s round to $0.50 for ease of calculation.

We can now fill in the missing numbers of Exhibit 3 to read as follows:

Exhibit 4:

If needed, share Exhibit 4 with the interviewee

Key insight:

Since total costs per unit are going down by $0.25, profit per unit is going up. The new profit margin is $3.25/$4.50 = 72%. This is a substantial increase and one that better positions the client against competitors

3. Profits

We now understand how this new product will affect both costs and revenues. We should now combine those factors to think in terms of profitability.

Recall that volume will increase to a total 650,000 vaccines sold each year (up from 450,000) and price will remain the same.

Profit margin on each sale increases from $3 to $3.25.

New profits will be:

Recall that volume will increase to a total 650,000 vaccines sold each year (up from 450,000) and price will remain the same.

Profit margin on each sale increases from $3 to $3.25.

$3 * 450,000 vaccines sold = $1,350,000 per year

New profits will be:

$3.25 * 650,000 vaccines sold = $2,112,500 per year for a total increase of $762,500

Make sure the interviewee doesn’t accidentally calculate incremental profit by multiplying the new profit margin by incremental sales (3.25 * 200,000). This will give an inaccurate answer as the profit margin has changed.

Key insight:

with the new product launch, profits will increase by about $760,000 per year.

4. ROI

In order to evaluate the return on investment, we should compare the additional profits with the investment required.

The setup to launch the new product will require a be a one time cost of $1.5 million. All research and development costs for the new vaccine have already been incurred for a total of $5 million.

Key insight: with the new product launch, profits will increase by about $760,000 per year. Given that the investment required for introducing the product is $1.5 million, the new vaccine will break even in less than two years, which is extremely fast.

The interviewee should not bring any sunk costs (i.e. $5 million in R&D) into this equation.

5. Other considerations

Prompt the interviewee to focus on risks and other non-financial factors to assess if this product launch is a good move for the client.

- Capacity and utilization: does the current facility have enough capacity to increase production at this level? If so, what are some other ways this capacity could be utilized?

-

Patent and regulations: is this new product already approved for distribution? Has our client been able to secure a patent and when will it expire?

-

Competitor response: do we expect competitors to introduce similar products? How will that affect our profitability model?

- Strategic fit: is our client looking to grow at this rate and does this new product fit well with its core values and mission? Is this a good time for such a bold move?

- Changes in the market: are there any market trends our client should be aware of before launching this product? I.e. are ferrets going out of fashion? Is rabies as big of a concern as it once was?

6. Financial recommendation

The CEO of Pet Vaccines, Inc. walks in the room and wants to know what you think. Should he launch the new product?

Pet Vaccines should launch this new product immediately since it would recover its investments in two years, a very short timeframe. The additional profitability of 0.76m is driven by a 44% increase in revenues and 6% increase in profit margin due to lower average per unit costs linked to larger scale in production. However, there are some risks and other considerations I would like to investigate further before issuing a final recommendation including capacity limitations, IP protection, and domesticated ferret market trends.